A new analysis from LendingTree reveals that age plays a key role in where people own homes in the U.S. The study examined the 50 largest metros, looking at the average age of both homeowners and renters. It found that the average homeowner is between 50 and 51 years old, while the average renter is just shy of 45. By contrast, the general population averages just 39.

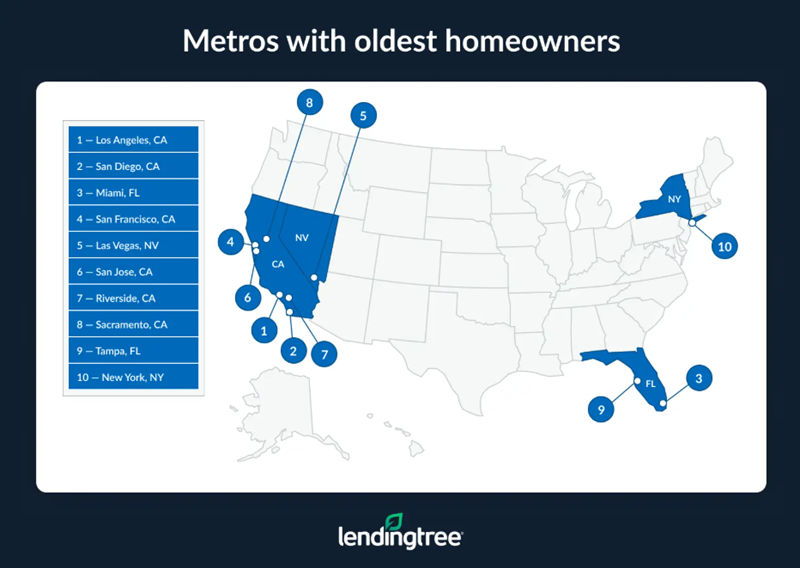

The metros with the oldest homeowners are largely concentrated in California and Florida. Los Angeles leads the list, with an average homeowner age of 54.60, followed by San Diego at 53.63 and Miami at 53.38. These markets also show high monthly housing costs. In Los Angeles, for example, the median monthly housing cost for homeowners with a mortgage is $3,176, compared with $1,970 for renters. In San Diego, those costs rise even higher, with homeowners paying $3,211 and renters $2,243.

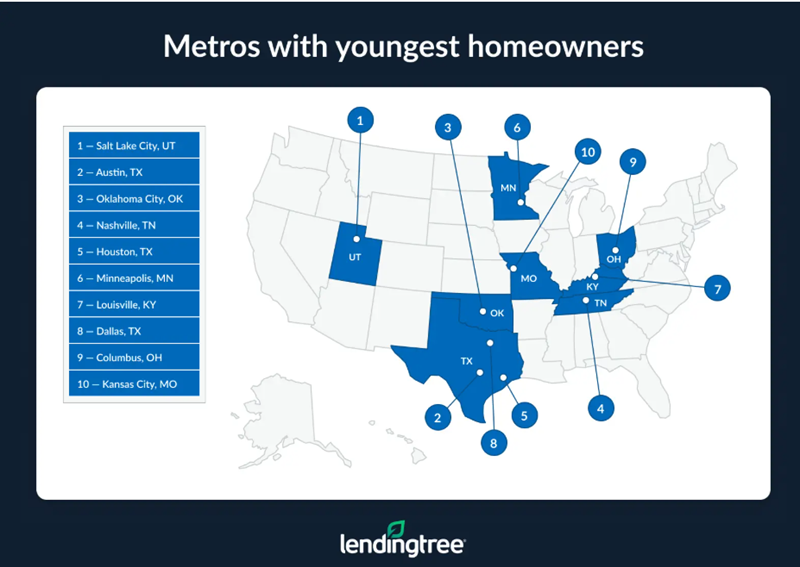

On the other side of the spectrum, younger homeowners are clustering in metros with more affordability. Salt Lake City has the youngest homeowners, averaging 48.09 years old, followed by Austin at 48.75 and Oklahoma City at 48.79. Salt Lake City renters average just under 40 years old, compared to a general population average of 35.55. Housing costs in these metros are relatively more affordable: Oklahoma City homeowners pay a median of $1,766 a month, with renters at $1,110.

The study also notes that renters are about six years younger than homeowners overall. In some metros, especially on the East Coast, renters skew older. For example, Miami renters average 47.81 years old, while New York City renters average 48.96. Meanwhile, younger renters are clustered in Southern metros, where affordability and job growth continue to attract younger populations.

Matt Schulz, LendingTree’s Chief Consumer Finance Analyst, explained what shapes these housing choices.

“Things like a booming job market, an affordable cost of living, robust entertainment options, low crime rates, easy access to education and temperate weather are going to make a metro appealing to just about anyone,” Schulz said.

That being said, he continued to explain how priorities in generations seem to differ: “For younger homeowners, affordability and job opportunities may be even more important than they are for older homeowners.”

He added that, “Meanwhile, health care options may be more important for older Americans.”

The data also reflects broader generational trends. According to the National Association of Realtors (NAR), Gen Z and millennial homebuyers have been drawn to the Midwest in recent years, attracted by lower costs and more available starter homes. In contrast, eight of the 10 metros with the oldest homeowners are in just two states (California and Florida), where prohibitive costs and older populations dominate.

Ultimately, Schulz emphasized that age shapes what people need in a home and where they look for it. “Age plays a huge role in someone’s homebuying journey, simply because the stage of life that you’re in goes a long way toward determining what you need and what is available to you,” he said.

Click here for more on LendingTree’s analysis of the nation’s the oldest and youngest homeowners and renters.