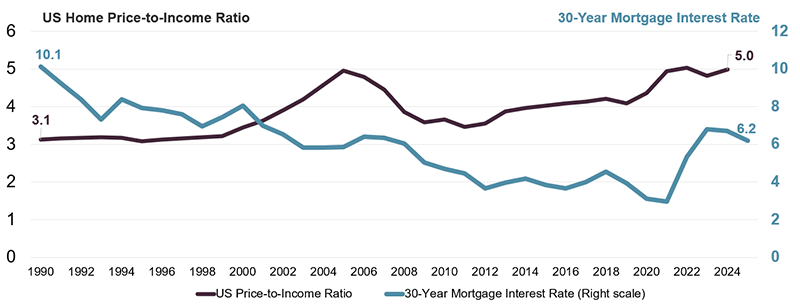

The average 30-year mortgage rate now hovers at around 6.2%, just over half a percentage point lower than the 6.8% average recorded earlier this year. Despite this, homebuying activity remains stuck near three-decade lows, presenting a clear sign that it’s not just interest rates, but also sky-high home prices, that continue to block millions of Americans from entering the housing market.

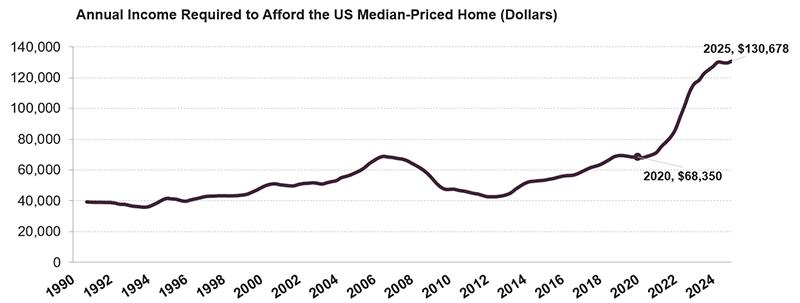

As detailed in a post from Harvard University’s Joint Center for Housing Studies, mortgage costs have more than doubled since 2020, leaving many would-be buyers unable to afford even modest homes. For example, the typical first-time home purchaser with a small down payment now faces a monthly mortgage bill of roughly $2,500, compared to just $1,200 five years ago. To qualify for such a loan, a household would need to earn more than $130,000 a year, nearly twice the income required in 2020.

While today’s mortgage rates may feel high compared to the ultra-low levels seen during the pandemic, they are not extreme by historical standards. Home prices, however, are another story. Nationally, prices have surged about 50% since 2020, pushing the median home to a record five times the median household income. This is a level not seen before in U.S. housing history.

Even a full percentage-point drop in rates would only reduce monthly mortgage payments by about as much as a 10% decline in home prices. To return affordability to 2020 levels, rates would have to fall close to zero (clearly, an unrealistic scenario, especially since rising property taxes and insurance costs would still keep total payments higher than before).

The bottom line is that lower interest rates alone can’t solve the affordability crisis. The only sustainable path forward will likely come from slowing home price growth and expanding the supply of more modestly priced housing. That means boosting construction of smaller homes, condos, and manufactured housing, which are all categories that have fallen far below historical building levels since 2010.

While the recent rate decline is a welcome sign for aspiring buyers, experts warn that true relief won’t come until more affordable homes are built, giving middle-income families a fighting chance to achieve homeownership once again.