In recent news, it was announced that the former President of Fannie Mae, David Benson, is returning to the government-sponsored enterprise (GSE) as a Senior Adviser.

The statement was posted by Bill Pulte, Director of the Federal Housing Finance Agency (FHFA) and the self-appointed Chairman of Fannie Mae, on his personal X account. Neither the FHFA website nor the Fannie Mae website made any official notice.

Pulte didn’t go into detail about what Benson’s responsibilities at Fannie Mae will be as of yet. From August 2018 until November 2023, Benson served as President of Fannie Mae. Pulte confirmed last week the departure of Priscilla Almodovar as President and CEO of Fannie Mae.

Benson now serves on the Board of Directors of Essent Group Ltd., a holding company with its headquarters in Bermuda that provides a range of insurance products to the housing finance industry, as well as the real estate fintech Opendoor.

The news of Benson’s return comes after Fannie Mae recently announced the appointment of two long-time industry veterans, Jake Williamson, Acting Head of Single-Family and Tom Klein, serving as Acting General Counsel.

“These highly respected leaders will help lead the company to increased safety and soundness and accelerated profitability,” Pulte said.

Additionally, Williamson is a part of the MortgagePoint’s Editorial Advisory Board, who is responsible for oversight and management of all end-to-end collateral, loan quality, and operational risk capabilities. These duties include front-end collateral policy design, loan quality control activities for both credit and collateral, condo standards, property valuations designation and modernization, appraisal bias oversight, real estate liquidation options, and Single-Family operational risk management.

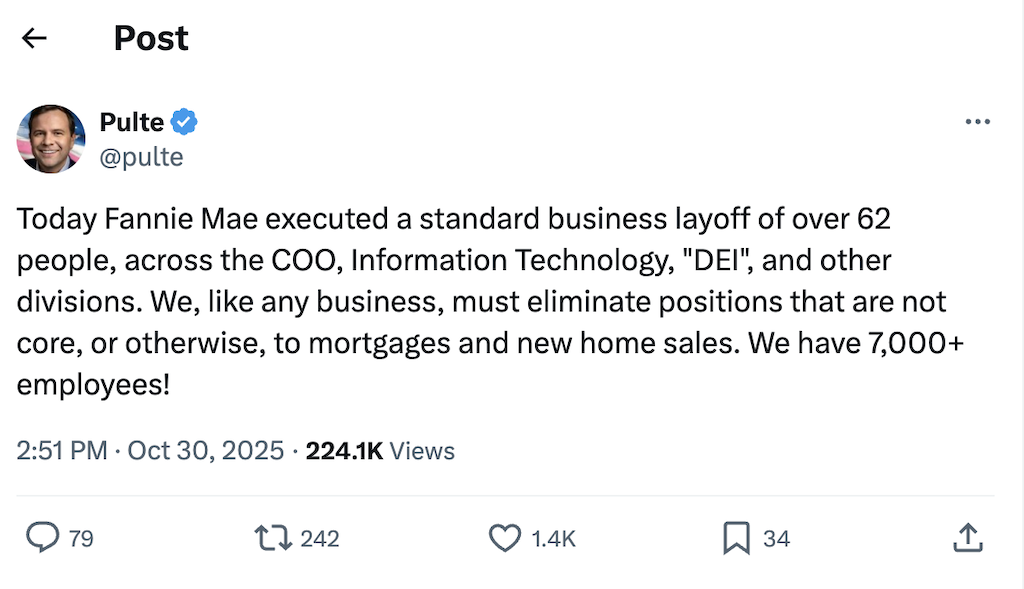

Pulte also revealed and addressed recent Fannie Mae layoffs in a post on X.

“Today Fannie Mae executed a standard business layoff of over 62 people, across the COO, Information Technology, “DEI”, and other divisions. We, like any business, must eliminate positions that are not core, or otherwise, to mortgages and new home sales. We have 7,000+ employees!” he said.

The news comes amid the ongoing government shutdown, as many consumers, homebuyers, sellers and owners remain uncertain about the economy and what the mortgage industry and housing market will look like going forward.