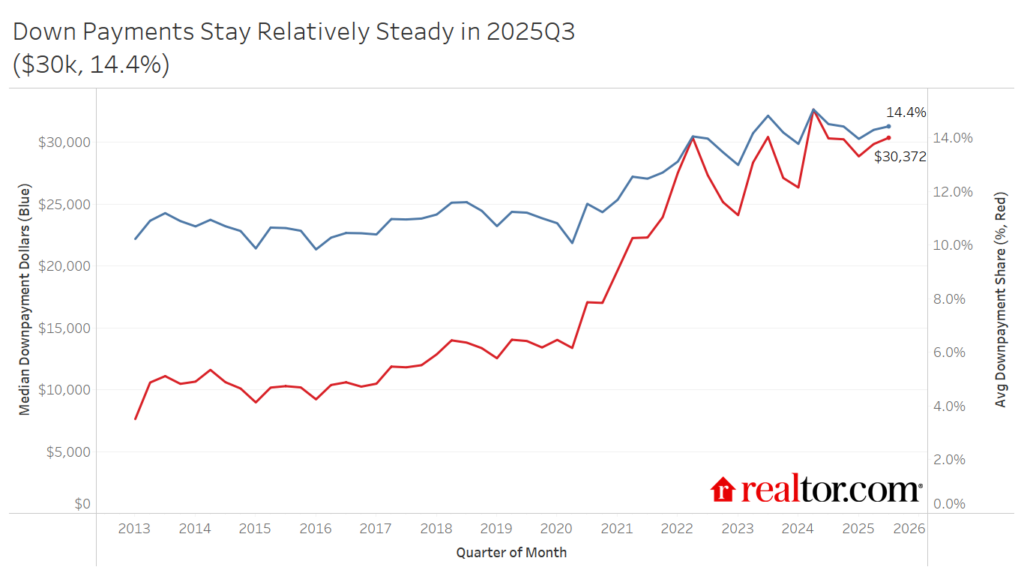

Down payments stayed largely unchanged this fall, signaling that housing affordability pressures are keeping buyers cautious but consistent. According to housing data from Realtor.com, the median down payment in the third quarter of 2025 was about $30,400, roughly the same as a year earlier and only $500 higher than the prior quarter. As a share of purchase price, down payments averaged 14.4%, continuing a pattern seen since 2022.

That stability marks a shift from the dramatic swings of the pandemic years. Historically, down payments rise through the busy spring and summer buying season, but this year’s increase was smaller than usual. From the first to third quarter, down payments rose just half a percentage point, which is far less than the typical pre-winter climb. The data points to a housing market that has cooled but remains shaped by high prices, limited inventory, and persistent affordability hurdles.

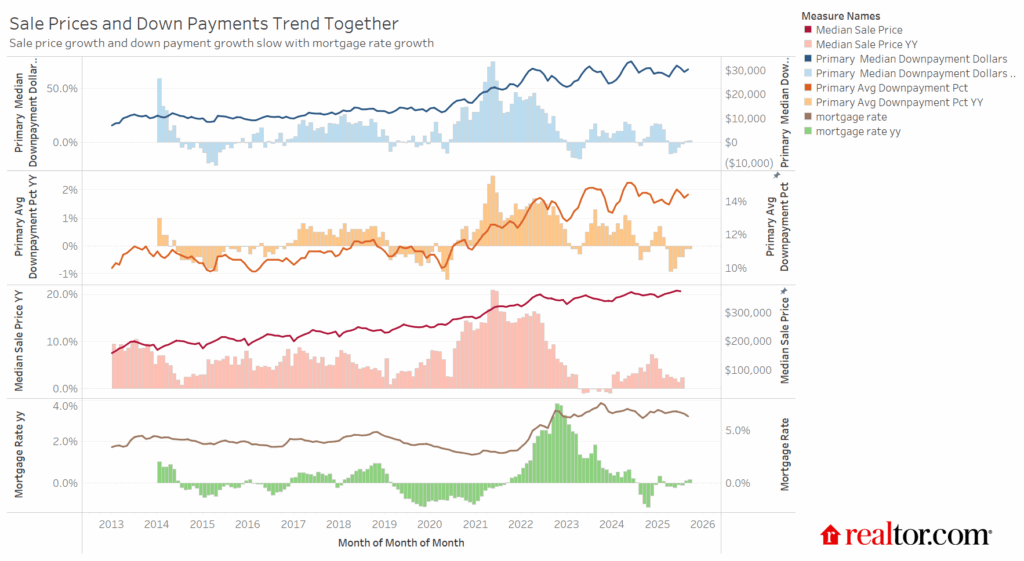

Even with slight moderation, today’s down payments remain well above pre-2020 norms. The typical buyer is contributing more than double what they did six years ago, reflecting the long-term rise in home prices. Between 2019 and 2025, the median home sale price increased nearly 45%, while the typical down payment jumped 118%. Though growth has leveled off since 2022, down payments have stayed elevated, generally in the upper $20,000 to low $30,000 range.

These higher amounts also reflect a housing market increasingly dominated by financially stronger buyers. The median homebuyer FICO score held steady at 735 in the third quarter, roughly 20 points above the national average. With high mortgage rates and expensive homes, the market has filtered out less-qualified or first-time buyers, leaving those with higher incomes and stronger credit in a better position to compete.

Regional patterns reveal similar divides. Buyers in the Northeast continue to make the largest down payments (around 18% of purchase price), while the South remains the lowest (about 12.5%). In the West and South, softer demand and more available homes have allowed modest easing, while tighter supply in the Northeast and Midwest has kept competition and upfront costs high.

As 2025 winds down, down payments appear steady but stubbornly elevated. Unless mortgage rates drop further or supply improves, affordability challenges will likely keep the market skewed toward wealthier buyers and leave many hopeful homeowners waiting on the sidelines.