According to new data from Realtor.com, 2025 has been a challenging year for the housing industry overall and for the new-construction sector specifically. Buyer demand for both new and existing homes has decreased as a result of the faltering labor market. On the supply side, labor shortages and additional building material tariffs have further reduced builders’ profit margins. In spite of the challenges, new building still stands out from the existing-home market in terms of buyer affordability.

After reaching a record in Q3 of 2022, the median listing price for newly constructed homes nationwide has since declined and remained largely stable over the previous three years. It was $451,337 in the third quarter of 2025, up 0.2% from the same period last year but down 4% from the peak in 2022. In the meantime, the price of an existing home has continued to rise, hitting $409,667 this Q3—up 1.6% from the previous year and 3.9% from Q3 of 2022.

Both new and existing home values have increased by roughly four percentage points over the last three years, but in different directions, since the height of the post-pandemic purchasing frenzy. For most of the past year, new construction has been less expensive per square foot than existing homes after accounting for size. This is because new builds are often larger than existing homes.

While this is true nationally, there are significant regional variations in prices. In the Midwest and Northeast, new homes are still much more expensive on a per-square-foot basis than older homes. The national average, however, leans toward the trends in those areas, where the cost per square foot for new building is lower, because more new construction activity occurs in the South and West than in the Midwest and Northeast. In addition to explaining why the national trends mirror those of the South and West, the quantity of new building in each region also explains why the size-adjusted prices of new homes are comparatively lower in those regions due to increased competition among builders.

New-Home Price & Construction Trends Offer More Choices for Buyers

Keeping new-home prices in check across the country has been the consistent pace of new building, adding properties to the market. While existing-home listings have not yet fully recovered to pre-pandemic levels, new-construction listings have recovered at a comparatively steady pace since inventory was so drastically reduced in 2021 and 2022, when mortgage rates were at all-time lows and buyer activity was high. However, the proportion of new-construction homes among all homes for sale has decreased to 16.7% in Q3 of 2025 due to the influx of existing homes into the market during the last two years and their extended stay.

The report also revealed that the new-construction premium has plummeted much more sharply. The premium is the percentage difference in the price of new-construction homes and existing homes and can be a marker of which is in greater demand in the market. It hit the lowest third-quarter metric in Realtor.com data history in 2025, at 10.2%. It is not a dynamic one would expect that new-construction homes are becoming comparatively more affordable at the same time that they are becoming comparatively more scarce in comparison to existing homes. Normally, experts equate declining relative pricing with increased relative supply, but that is not what is occurring currently.

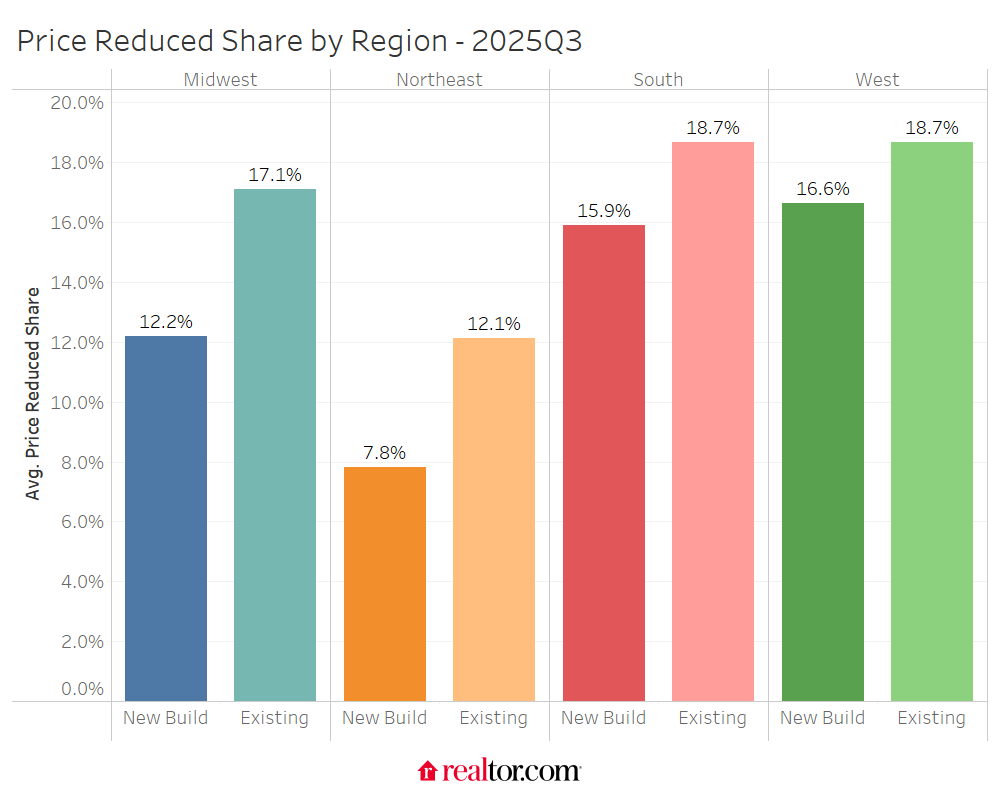

However, mentioning once more, this phenomenon is not consistent throughout the nation. Price reductions for new homes are significantly less frequent in areas like the Northeast, where new building is a relatively uncommon commodity, than in better-supplied markets like the South and West.

Regional & National Differences: For-Sale Listings & New Construction

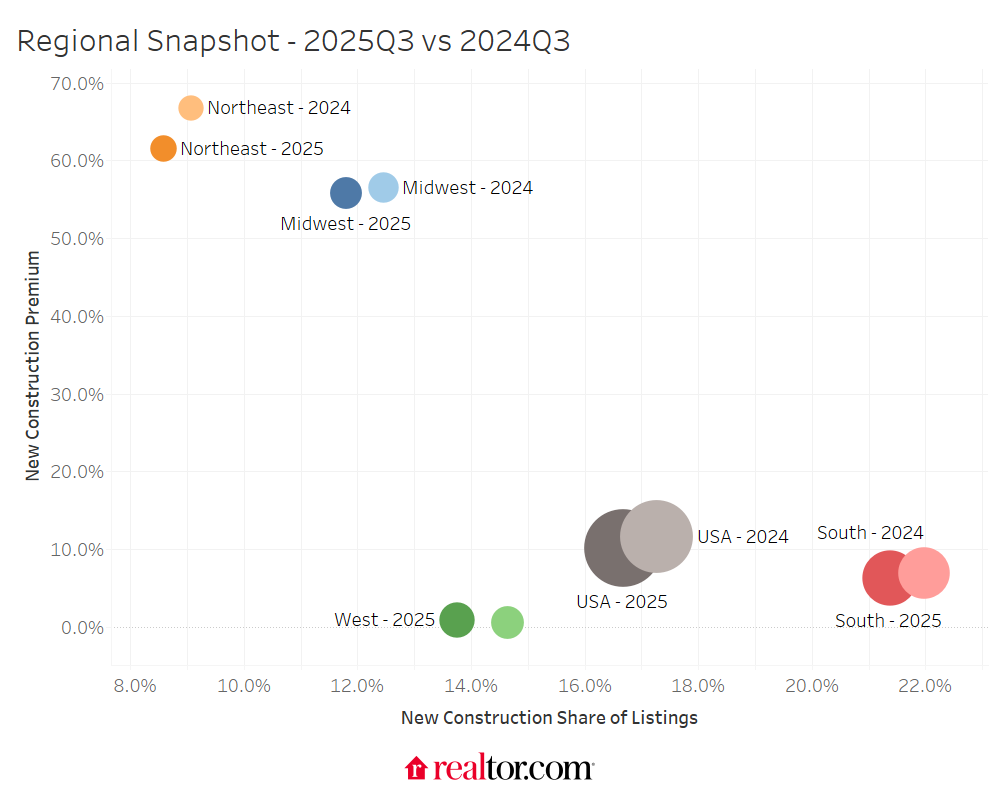

Taking a deeper look at the disparities between regional markets and the national market, experts discovered that new construction as a share of inventory is constantly declining year-over-year (YoY), but from quite different starting places. There are several different base levels and a range of YoY changes in new building pricing.

The vertical axis depicts the new-construction price premium—again, the percentage difference in costs between the median new build and the median existing home. Higher up the chart suggests that new building is priced further above existing homes, and further to the right means that new builds make up a bigger share of the market.

Note: The diameters of the bubbles show the quantity of new-construction listings in each geographic location.

Since most new-construction listings are from the South, the national market typically swings in tandem with the South. With the exception of the West, every region has seen a decline in the premium for new building, with the Northeast experiencing the biggest decline. The share of new building in each region has been diluted by the surge of older homes on the market, shifting the bubbles left YoY.

The immense gap of white space through the middle of the figure is yet another manifestation of the regional bifurcation of the housing market. In the South and West, where inventory has mostly recovered to pre-pandemic levels (thanks in part to builders delivering ample and affordable homes in those regions), new constructions have a single-digit price premium and all homes have a higher rate of price decreases. In the Northeast and Midwest, home to most of the hottest and most seller-friendly regions in the country, new construction is still a scarce premium product.

New Construction Provides Beneficial Financing to Buyers

In the latest Realtor.com study on the incentives being offered by builders, experts found that lowered rates were the most popular promotion advertised. In an environment where mortgage rates are higher, mortgage rate buydowns and below-market mortgage rates are a good strategy to draw buyers to new construction, and they lead to notable variations in the average rate held by buyers of new construction and buyers of existing houses. In Q3 of 2025, the average 30-year mortgage rate indicated on the deed of an existing-homebuyer was 6.26%.

For a new-home buyer, the average 30-year rate was 5.27%, approximately 99 basis points lower. This is a bit of an outlier figure, given the gap for the previous two quarters of 2025 were 51 and 54 bps, but there is reason to suppose that the peak late summer sales season employed more rate promotions than typical.

The spread between the rates grows when rates are greater, which is when decreased rates are most enticing. However, at a little lower range of mortgage rates, the disparity has recently exceeded its 2006 peak. It is consistent with the new-home segment’s inventory level, which peaked in 2006 as well. Builders use financing incentives when there are a lot of ready-to-move-in properties available. These incentives are pricey for builders, but they offer a potent tool for sealing a deal, and for purchasers, they result in much-needed relief on monthly payments.

Meanwhile, down payments on new house purchases are declining. In the past, buyers of new construction have typically paid greater down payments than buyers of existing homes, but in recent years, this tendency has changed. As a matter of fact, in the third quarter of 2022, both new and existing house buyers made reductions of 18.3% and 17.2%, respectively. In the most recent quarter, new-home buyers put down just 15.7% while existing-home purchasers put down 17.8% as a percentage of the purchase price.