After homes are damaged by weather-related and climate-related disasters, property insurance is a crucial instrument to aid in rehabilitation. However, because they do not own the buildings in which they live, renter households receive little financial advantage from property insurance, according to Harvard’s Joint Center for Housing Studies.

Over 18 million units, or over 41% of the country’s occupied rental stock, are located in counties that the Federal Emergency Management Agency’s (FEMA) National Risk Index classifies as “high-risk.” Renters may be financially and physically exposed when climate disasters occur due to loopholes in public disaster recovery programs and property insurance markets, even though many of them reside in hazardous locations.

Renters insurance is thought to be present in 55% of renter homes nationwide, indicating that nearly half do not. The building or apartment itself is not usually covered by a basic policy, but a tenant’s personal belongings are usually protected against various hazards. A renters policy may contain “loss of use” or “additional living expenses” coverage for covered risks, which offers money for temporary accommodation in the event that the rented property becomes uninhabitable.

However, a tenant will not be compensated to replace destroyed personal items or cover the cost of temporary lodging if they do not have renters insurance or are impacted by a hazard not covered by conventional renters policies (such as an earthquake or flood).

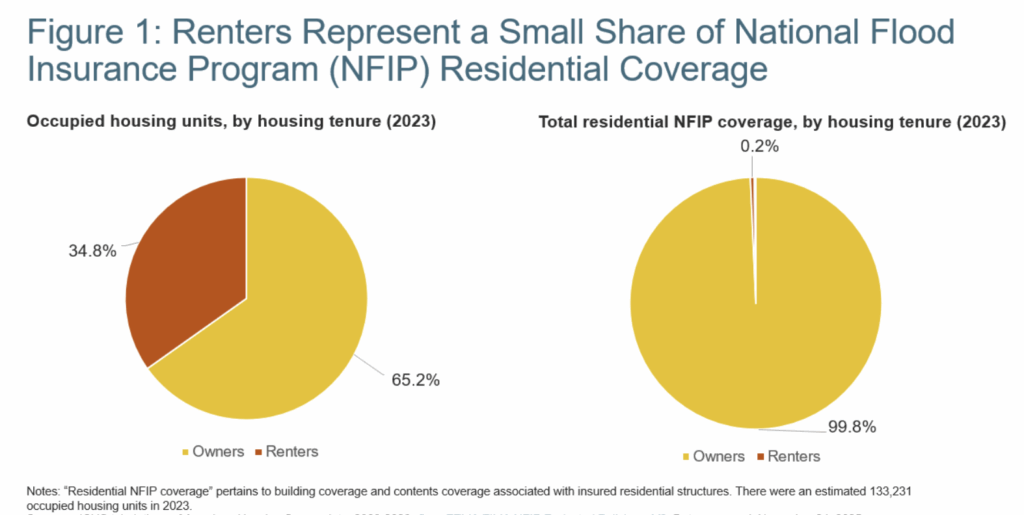

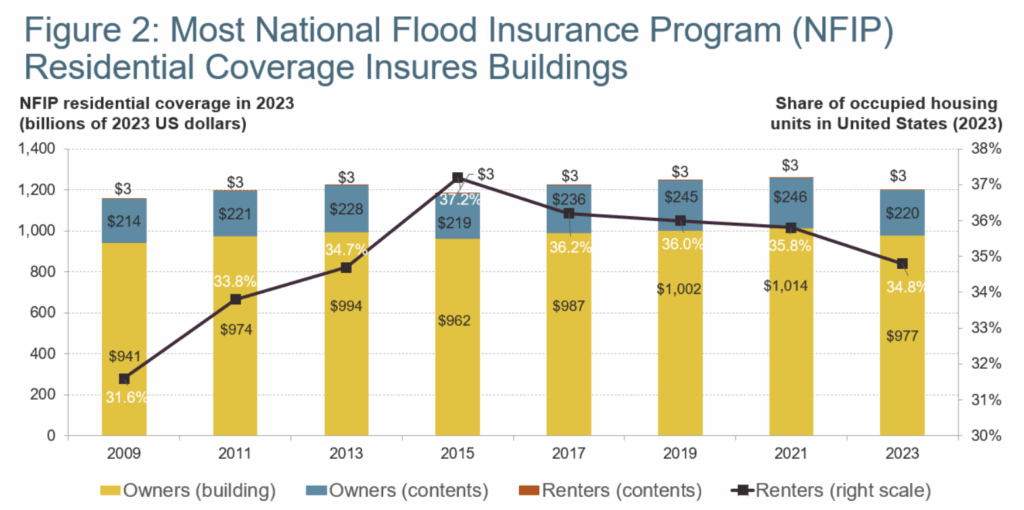

One risk that is not covered by typical renters’ or homeowners’ insurance plans is flooding. The National Flood Insurance Program (NFIP), which provides both “building coverage” and “contents coverage,” is used to write the majority of single-peril flood insurance policies in the US. Tenants in the NFIP only have access to contents coverage, as contrast to renters insurance, which may include “loss of use” coverage to cover interim lodging. Building owners are served by the great bulk of residential NFIP coverage, as seen in Figure 1. The bulk of residential NFIP coverage insures buildings, as seen in Figure 2.

Note: “Residential NFIP coverage” pertains to building coverage and contents coverage associated with insured residential structures. There were an estimated 133,231 occupied housing units in 2023.

Only 0.2% of all residential NFIP coverage covers the assets or belongings of renters, despite the fact that renters occupy about 34.8% of occupied residential units. According to research, the money received from property insurance payouts after a disaster can be used to cover a variety of ancillary costs, including temporary accommodation, evacuation costs, car repair, waste removal, and landscaping, in addition to the actual property damage.

Renters are not financially liable for building repairs or replacements because they do not own their homes. However, in the event of flood damage, a renter might have to deal with an uninhabitable house and little to no insurance money to help them recover.

In the wake of presidentially declared disasters, federal assistance programs like FEMA’s Individual Assistance Program can offer renters resources for temporary lodging; however, these resources are not always available because of program qualifying requirements.

Renters are impacted by the growing expense of property insurance, just like homeowners. Rising commercial property insurance prices are a problem for many landlords, and some of these expenses are being passed on to renters in the form of increased rent. This occurs at a time when the number of renters who are struggling financially is already at an all-time high. 58% of 418 multifamily housing providers surveyed in 2023 said they had increased rent to cover rising insurance costs. In order to offset insurance costs, comparable percentages of respondents said they have reduced or postponed other building investments and running expenses.

Property insurance is one strategy that can manage financial risks from future extreme weather occurrences as environmental threats and affordability issues combine with a changing climate. Alternative risk management strategies, such as investments in physical risk reduction, renter-focused financial product innovation, or improvements to current disaster assistance programs, must be taken into consideration to protect renters since property insurance offers them little direct financial protection.

Developers of inexpensive housing are likewise under pressure from rising insurance costs; therefore, upstream interventions that lower insurance costs for these builders and owners may assist renters downstream in terms of housing supply and rental pricing.