According to TransUnion’s Q4 2023 Quarterly Credit Industry Insights Report (CIIR), credit card debt is at an all-time high due in part to millennials adding more credit to their portfolios. This comes at a time when new ways for more reasonably priced borrowing may become available due to the predicted drop in interest rates over the course of the upcoming year.

As a result of a 13% year-over-year (YoY) increase, bankcard balances set a new high in Q42023, reaching the $1 trillion threshold for the first time. All risk categories saw an increase in balances, with subprime growing 32% YoY to $105 billion. In terms of bankcard balances, the Gen X share remained the highest at 33.8%, while the millennial share was lower at 29.4%.

With an estimated 29.6% of all new bankcard originations in Q3 2023, overall, millennials led the originations share.

“Inflationary pressures and higher-than-expected living costs have led to many consumers turning to bankcards to help make ends meet in recent quarters, and Millennials are no exception,” said Michele Raneri, VP and Head of U.S. Research and Consulting at TransUnion. “It’s worth watching how this generation uses credit in the coming year, one which will likely see some positive economic developments play out, but also challenges. Among these challenges will be the end of the one-year on-ramp to student loan payment resumption, something that may impact many consumers in this generational group.”

In 2023, the percentage of bankcard balances held by millennials surpassed that of baby boomers for the first time.

Percentage of credit card debt in Q4 of 2023:

- Gen Z (6.3%)

- Millennial (29.4)

- Gen X (33.8)

- Baby Boomers (26.7%)

- Silent (3.8%)

The share of Gen Z originations is increasing as the mortgage market remains slow due to high interest rates.

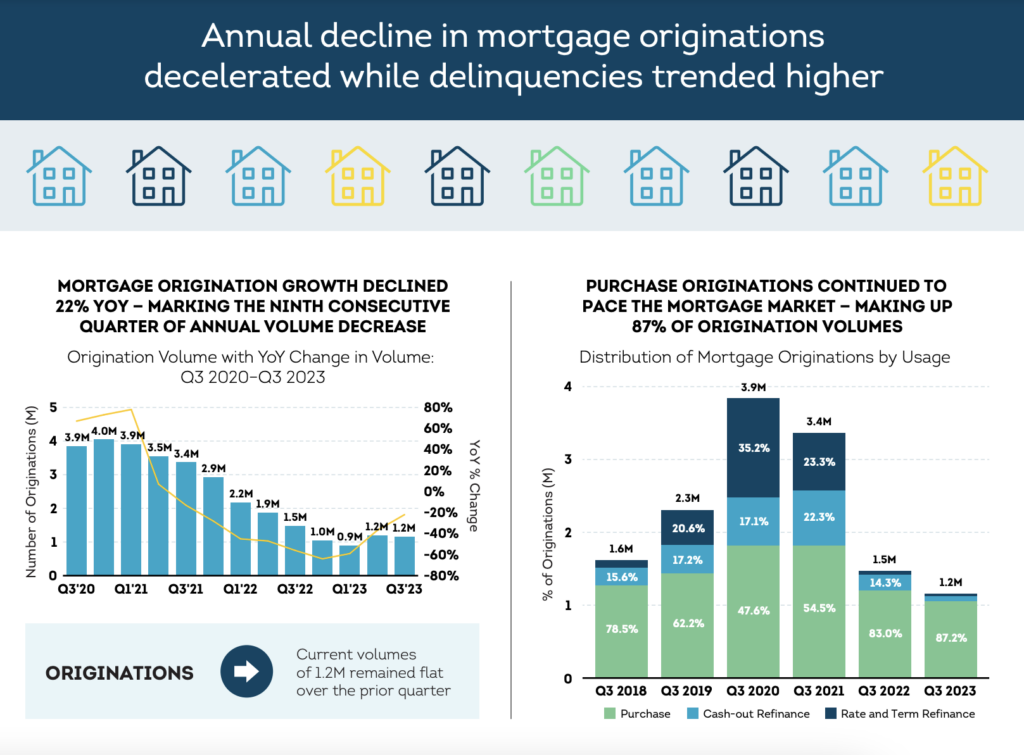

YoY drops in origination volumes remained, falling 22% to 1.2 million in Q3 2023. But this was the least amount of a YoY fall in the previous seven quarters, suggesting that the mortgage origination market might be close to bottoming out. During the quarter, purchase originations decreased 18% year over year, while rate and term refinancing decreased 27%. In Q4 2023, cash-out refinancing fell 44% YoY.

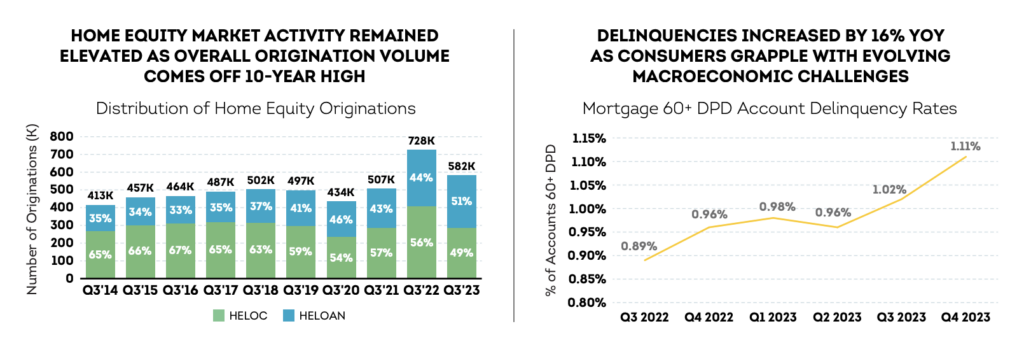

As more Gen Z consumers reach the typical homebuying age, their share of mortgage originations increased from 9.6% in Q3 2022 to 13.2% in Q3 2023, while the shares of all other groups decreased during the same period. The post-pandemic increase in originations in the home equity market has decreased, but it is still above recent historic norms, with 582K originations in Q3 2023. Since 2008, this is the second-highest Q3 on record.

“Persistently high mortgage rates remain a significant headwind in the mortgage market, particularly affecting demand for refinance,” said Satyan Merchant, Senior VP of Automotive and Mortgage Business Leader at TransUnion. “Purchase originations will continue to drive the mortgage market over the next several quarters, as demand for refinance will depend on mortgage rates falling significantly below current high levels. The 2022 resurgence in home equity lending continued to recede in Q3 2023, with both HELOCs and HELOANs coming off the 10-year highs seen the year prior.”

Originations were lower YoY for both home equity lending products and unsecured personal loans combined. This is an important development as both programs may provide homeowners and consumers with lower-interest options for refinancing expensive credit card debt. Q3 2023 saw a 10% YoY decline in unsecured personal loans, marking the fourth consecutive quarter of declining origination volume. This decline can be attributed to lenders becoming more selective in their loan decisions and ongoing capital restrictions facing FinTech lenders.

Although home equity lending is still stronger than it was before the pandemic, more homeowners have been waiting to take advantage of available home equity while interest rates are still high, as evidenced by the significant YoY declines in HELOC and HELOAN originations in Q3 2023 of 29% and 8%, respectively.

“If the expected Fed interest rate cuts over the course of 2024 take place, lenders may find opportunity as consumers carrying elevated card balances seek to lower their monthly payments by refinancing high-cost debt into a lower interest product,” said Raneri. “Consumers should know their credit scores and work to improve them where possible. This will ensure they are as well-positioned as they can be to take advantage of those lower rates if the opportunity arises.”

To read the full report, including more data, charts, and methodology, click here.