Home sales have been facilitated by real estate agents for over a century. But at what cost? The guidance and knowledge of a qualified third party has significantly helped homebuyers and sellers, but that service isn’t free. However, many are unaware that those fees have the potential to be negotiated.

According to a new LendingTree survey, over two-thirds of buyers or sellers successfully negotiated a lower commission rate with their real estate agent.

“Like most things in life, you won’t know if your real estate agent will be willing to lower their commission fee until you ask,” said Jacob Channel, LendingTree Senior Economist. And in some cases, he says, “it can quite literally pay off.”

Key Findings:

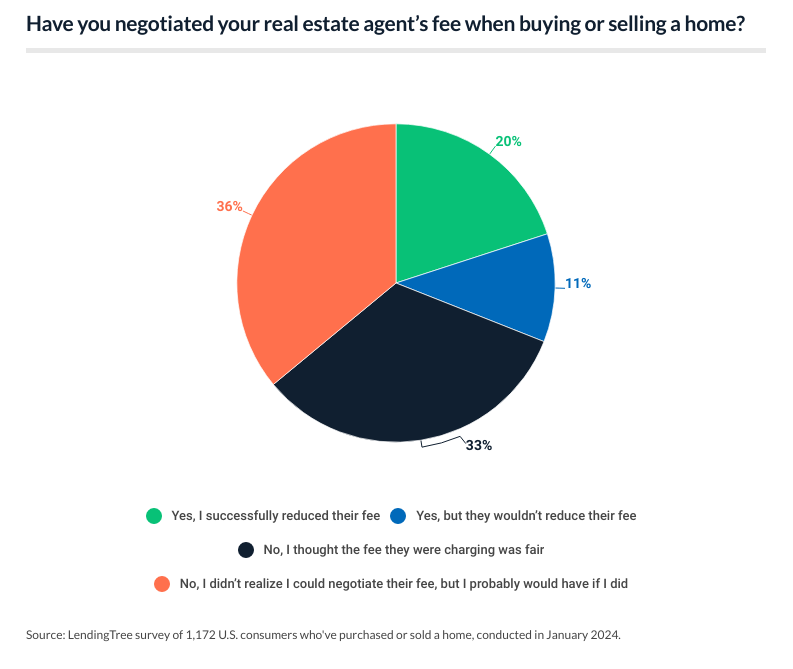

- Lower real estate fees can come to those who ask. While just 31% of homebuyers or sellers have attempted to negotiate real estate agent commission fees when buying or selling, 64% of those who asked successfully reduced theirs. Additionally, 36% say they weren’t aware negotiating was an option but would have tried if they were. Overall, 84% of Americans believe real estate agents should be flexible with their commission.

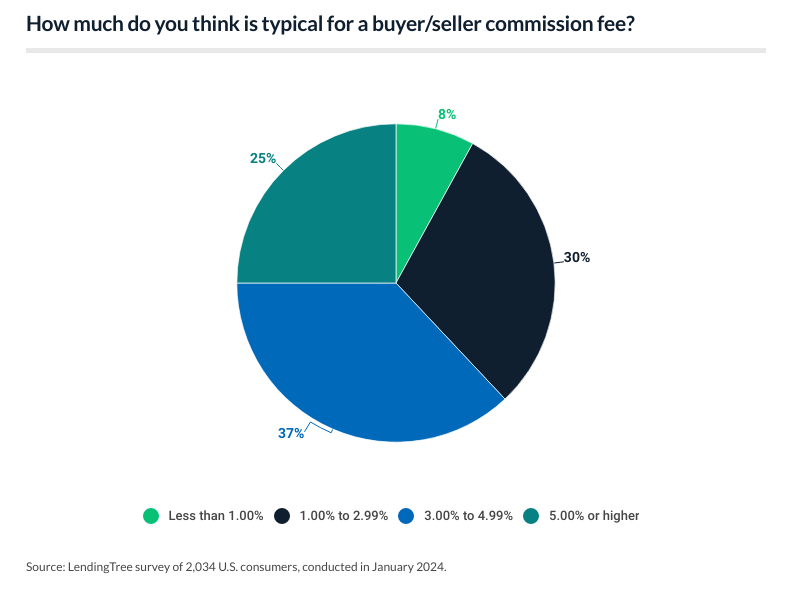

- Many Americans are in the dark on fees. Among homebuyers or sellers, 48% admit they don’t know what percent commission their agent received in their last transaction. 44% of those who know say their agent received between 3.00% to 4.99% in their last transaction, while 30% say it was 5.00% or higher. When asked what they believe a typical commission fee is, 37% of Americans said 3.00% to 4.99%, while 30% said 1.00% to 2.99%.

- Most consumers find real estate agents necessary in the homebuying/selling process, but technology may change that. An estimated 64% of Americans believe a real estate agent is at least somewhat necessary when buying or selling. However, 44% say they would attempt a real estate transaction without an agent. When asked if they think online tools and services have made agents less necessary in transactions, 64% agreed.

- Most Americans say they know how agents are compensated, though they may disagree with the practice. Some 64% of Americans believe they have a general understanding of how agents are paid. However, when asked their opinion, 11% said the buyer should be responsible for the entire commission and 20% said the seller. Over a third (35%) of homebuyers or sellers say they’ve been asked to pay the other party’s real estate agent fees in a transaction—more commonly the buyer than the seller.

Lower Real Estate Fees Can Come to Those Who Ask

Out of the 2,034 respondents to LendingTree’s study, some 58% reported buying or selling a property. Perhaps not surprisingly, compared to millennials ages 28 to 43 at 48% and Gen Zers ages 18 to 27 at 27%, baby boomers ages 60 to 78 and Gen Xers ages 44 to 59 were more likely to report purchasing or selling.

Approximately 31% of those who have purchased or sold a home have tried to negotiate their agent’s commission, 20% have been successful in doing so, and 11% have not. Additionally, roughly 36% of buyers and sellers claim they would have tried these discussions if they had known the opportunity was available.

According to Channel, requesting a fee decrease from your agent can be intimidating, but if you’re successful, it can end up saving money for both of you. Even while sellers usually pay the commission to the agent, purchasers may be able to save money if saved expenses are deducted from the agreed sale price of a home. The seller may be able to use the money they save on relocation costs or a down payment on a new house.

The majority of respondents are on board, even if a comparatively small percentage tried to negotiate and have the big conversation. Indeed, according to 84% of Americans, real estate brokers should be able to adjust their fees as needed. This is in line with the greater percentages of parents with children 18 years of age or older (88%), baby boomers (92%), and six-figure earners (91%).

Many Americans Remain in the Dark About Commission Fees

To put it simply, many Americans are unaware of real estate agent costs, which makes negotiating their prices potentially more unsettling. Although more than 52% of buyers and sellers claim to be aware of the percentage of commission their agent earned during their most recent real estate transaction, 48% acknowledge they are unaware of it. Men were more likely to claim they were aware—63% versus 43% for women.

When it comes to their agent’s charge, the majority of respondents who indicate they knew (44%) state it was between 3% and 4.99% of the sale price, while 30% claim it was 5% or more.

But what can sellers and buyers of real estate in this area expect in the future?

“Commission fees can vary significantly based on factors like who your agent is, what kind of home is being sold, where the home is being sold and how much the home is worth,” said Channel.

According to data gathered by LendingTree, the average commission is 5.37% of a sale’s price—which, depending on the price of the home, can add up to “thousands, if not tens of thousands, of dollars,” he said.

The good news is that this percentage represents the total amount of compensation due to the agents representing the sellers and buyers.

According to Channel, the commission is often divided equally between those two parties. Once more, even though the seller typically covers both costs, they might raise the asking price of the house in advance to meet this cost, meaning that the buyer may ultimately be responsible for a portion of the cost.

Despite Tech Advances, Most Consumers Still Find Real Estate Agents Necessary

It might appear that using a third-party is less required now that buyers and sellers have access to so many internet resources, but most consumers disagree, which is unexpected—and positive for those in the business.

In general, 64% of Americans concur that real estate brokers are essential to the process of buying or selling a property, with 24% stating that they are “extremely necessary.” Just 9% of respondents believe real estate brokers are neither very nor at all necessary, compared to 28% who are neutral.

Consistent with those conclusions, although 44% of respondents say they would, over half (56%) say they wouldn’t try to buy or sell a house without an agent, according to the report.

Although most customers still believe that agents are essential, many are prepared to acknowledge that things might be changing. Some 64% of respondents agreed that real estate agents are no longer as important in real estate transactions as they once were due to the availability of online tools, information, and services.

Leading this category are:

- Parents with children under the age of 18 (73%)

- Individuals earning $100,000 or more annually (71%)

- Men (69%)

“In the past, you may have been able to advertise your home in places like your local newspaper, but the amount of space you had for that advertisement was very limited compared to what you can now do online,” said Channel. “On top of that, the internet also makes it easier for sellers to get in touch with people who can help them buy a new house or navigate the sale of their current one like mortgage lenders or attorneys.”

However, agents can facilitate showings, help with paperwork, offer staging assistance, and more to make the process go more smoothly. Although selling a house on your own will save you money, Channel points out that “while selling a house on your own can save you money in commission costs, it still might not be worth it in the end.”

To read the full report, including more data, charts, and methodology, click here.