Lions, tigers, and no homes available, oh my! According to a new Redfin study, approximately 78% of older American homeowners intend to remain in their existing residence as they get older.

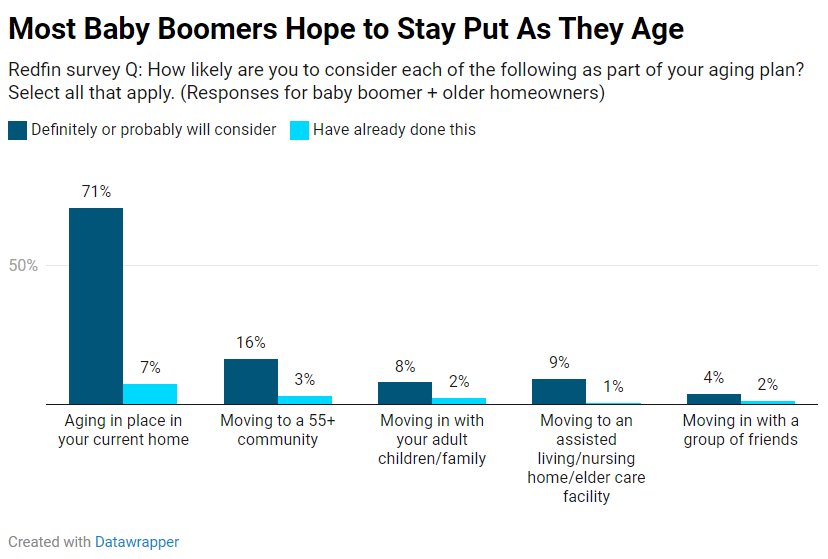

Staying in one’s present home is by far the most popular aging plan for older homeowners, according to a new Redfin survey asking baby boomers about their future living arrangements.

Moving to a 55+ community is the second most popular strategy; 20% of baby boomers are either contemplating or have already moved into a 55+ community. The next two options mentioned by baby boomers are moving in with adult children (10%) and relocating into an assisted-living facility (10%), while moving in with friends comes in second (6%).

Based on a Qualtrics poll that Redfin commissioned in February 2024, roughly 3,000 American homeowners and renters participated in the nationally representative poll. According to Redfin’s analysis, the outcomes for baby boomers who rent their homes are comparable to those for homeowners.

Aging in Place Contributing to U.S. Housing Shortage

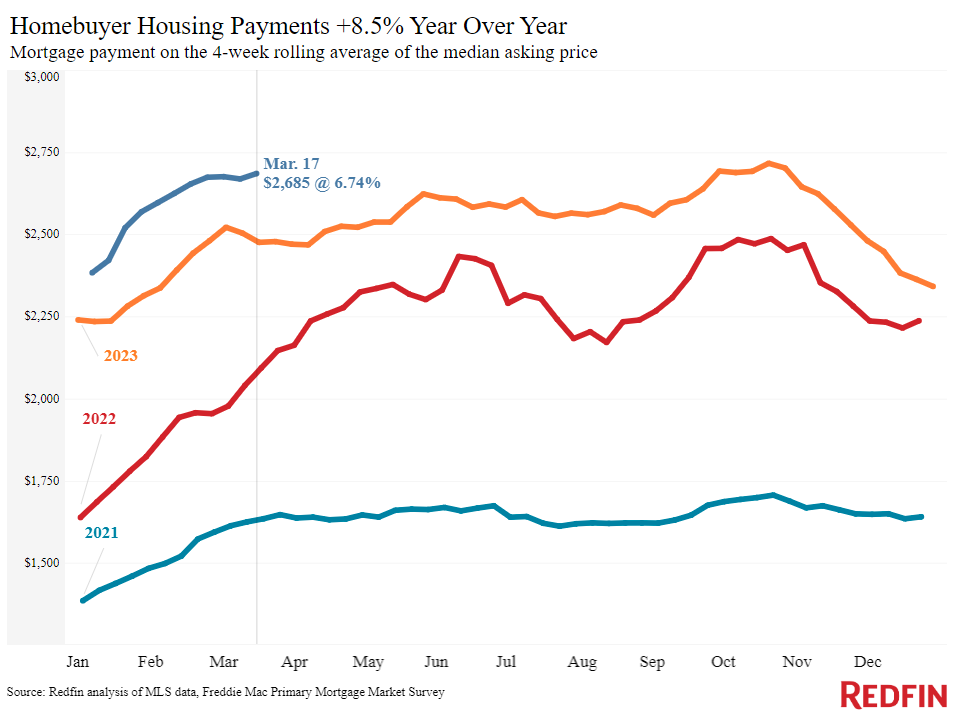

Per the report, the significant lack of available properties for sale may persist since the great majority of baby boomer homeowners intend to age in place. Homeowners who obtained extremely cheap mortgage rates during the recession are remaining there in order to avoid taking on a new rate at today’s increased levels, which is largely the reason why inventory is sitting at historically low levels—athough new listings have been growing in recent months. Those who own those homes are mostly baby boomers.

According to a similar Redfin report, one reason young Americans are having trouble finding a family home is because baby boomers are staying put. Baby boomers with empty nests hold 28% of homes in the United States with three bedrooms or more, compared to just 14% owned by millennials with children. Compared to millennials, who own homes at a rate of 55%, baby boomers, who own homes at a rate of over 80%, have a disproportionately large impact on the housing market.

More than half of baby boomers have resided in their houses for more than ten years, according to Redfin, which also revealed that older Americans’ decision to remain in their homes is a major factor in the rising homeowner tenure and dearth of available properties. In conclusion, reduced supply ultimately drives up home prices, making the nation’s housing affordability issue worse.

Older Americans are Aging in Place Because it Makes Financial Sense

The lack of financial incentives for baby boomers to sell their homes is a major factor in their continued ownership of them. When it comes to boomers who own homes, the majority (54%) have no mortgage, and of those who do, almost all have interest rates that are significantly lower than what they would pay if they sold and purchased a new home.

Certain states’ tax structures, such as those in Texas and California, also financially favor seniors living in their homes as they get older. Furthermore, Americans can increasingly age in place as a result of technological and medical breakthroughs.

“Older Americans are aging in place because it makes financial sense, but also because it’s human nature to avoid thinking about challenging scenarios such as needing help as you get older,” said Daryl Fairweather, Chief Economist at Redfin. “In reality, many homeowners and renters will need to move somewhere that better meets their needs as they age, like a senior-living community or a one-story home in an accessible neighborhood. But the government isn’t prioritizing building housing for seniors, which is further encouraging older Americans to stay put, exacerbating the inventory shortage. Politicians should focus on expanding housing stock that meets the needs of older Americans, which could help with housing affordability and availability for all.”

According to the same Redfin study, some 51% of baby boomers who don’t want to sell their house anytime soon said they don’t like it and don’t see a need to relocate. Approximately one in five (21%) are remaining put because home prices are currently too expensive, while more than a quarter (27%) say it’s because their property is paid off totally or almost completely.

To read the full report, including more data, charts, and methodology, click here.