Freddie Mac has announced that it has sold via auction 20 deeply delinquent non-performing residential first lien loans (NPLs) from its mortgage-related investments portfolio to GITSIT Solutions LLC. The loans, with a balance of approximately $5.7 million, are currently serviced by Specialized Loan Servicing LLC and NewRez LLC, d/b/a Shellpoint Mortgage Servicing.

The sale is part of Freddie Mac’s Extended Timeline Pool Offering (EXPO) and the transaction is expected to settle in June 2024. Freddie Mac, through its advisors, began marketing to potential bidders, including non-profit organizations and Minority, Women, Disabled, LGBTQ+, Veteran or Service-Disabled Veteran-Owned Businesses (MWDOBs), neighborhood advocacy organizations and private investors active in the NPL market.

Given the delinquency status of the loans, the borrowers have likely been evaluated previously for loss mitigation, including modification or other alternatives to foreclosure, or are in foreclosure. Mortgages that were previously modified and subsequently became delinquent comprise approximately 27% of the aggregate pool balance. Additionally, purchasers are required to honor the terms of existing loss mitigation agreements and solicit distressed borrowers for additional assistance except in limited cases and ensure all pending loss mitigation actions are completed.

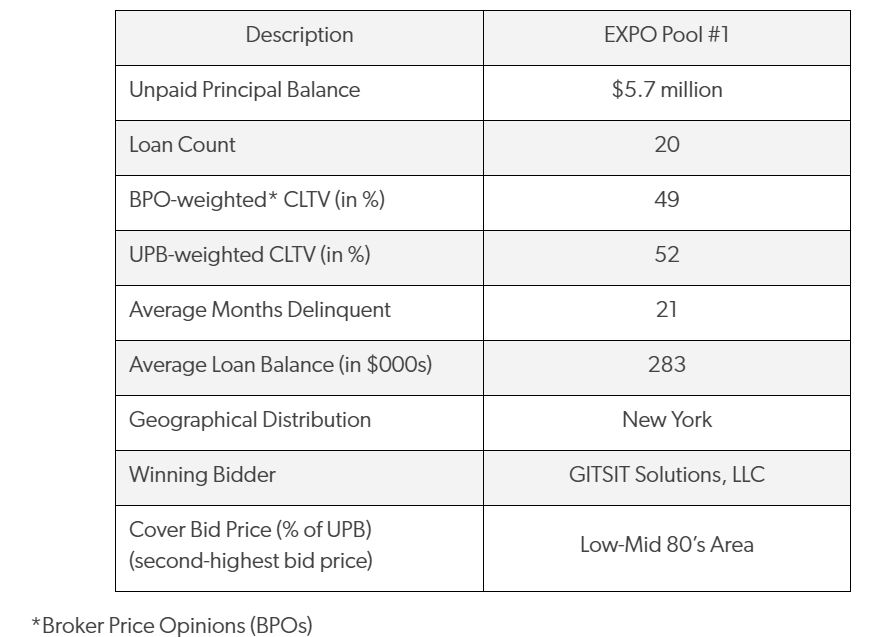

The EXPO pool and winning bidder is summarized below:

Latest NPL transaction

Freddie Mac recently announced the sale of 679 deeply delinquent NPLs via auction from its mortgage-related investments portfolio. The loans, with a balance of approximately $104 million, are currently serviced by Specialized Loan Servicing LLC and NewRez LLC, d/b/a Shellpoint Mortgage Servicing. The transaction is expected to settle in June 2024.

A history of NPL sales

Freddie Mac’s seasoned loan offerings includes sales of NPLs, securitizations of re-performing loans (RPLs) and structured RPL transactions.

Since 2011, Freddie Mac has sold $10.2 billion of NPLs and securitized approximately $78.3 billion of RPLs consisting of $30.4 billion via fully guaranteed MBS, $35.5 billion via the Seasoned Credit Risk Transfer (SCRT) program, and $12.4 billion via the Seasoned Loans Structured Transaction (SLST) program. Requirements guiding the servicing of these transactions are focused on improving borrower outcomes and stabilizing communities.