A new Zillow report reveals the disparities in housing affordability across the U.S., particularly between BIPOC (Black, Indigenous, and Other People of Color) and white renter households. Although the magnitude of rent increases has slowed since peaking in 2022, nearly half of all renter households remain cost-burdened, with BIPOC households disproportionately impacted.

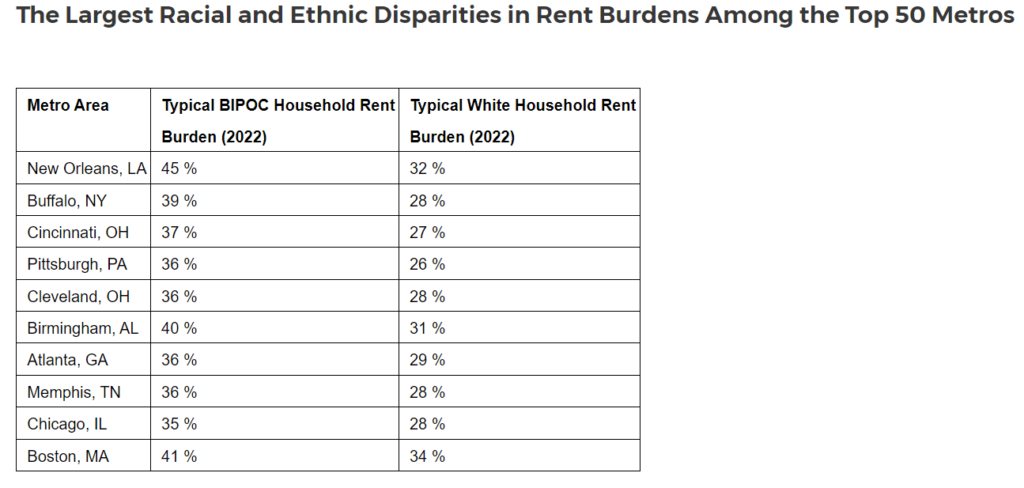

According to Zillow’s data, in 2022, the typical BIPOC renter household in the U.S. spent 34% of their income on rent, while white households spent 29%. Greater disparities appeared in several of the country’s major metro areas, such as New Orleans, where BIPOC households spent 45% of their income on rent, compared to 32% for white households. Notably, the median income of white renter households in New Orleans was 61% higher than that of BIPOC renter households. Although racial income gaps have narrowed over time, Zillow found that these figures underscore significant and persistent inequalities in housing affordability.

“Despite a recent slowdown in rent hikes, rent burdens remain critically high, particularly in BIPOC communities. These financial pressures not only make homeownership increasingly elusive, but also contribute to a broader economic disparity,” said Zillow Senior Economist Orphe Divounguy. “Combined with a persistent housing deficit and lower incomes, people of color have fewer housing options, are less likely to own, and those who do own have lower home values. We need focused efforts to tackle these issues, as stable housing is key to improving health, education and economic opportunities.”

The burden of rent growth

Expanding housing voucher programs

HCVs, also known as Section 8 vouchers, are designed to help low-income families by paying rent subsidies directly to landlords on behalf of the families. Families then pay the difference between the actual rent and the amount subsidized by the program, typically 30% of their income, up to a rent ceiling based on fair market rent estimates from the Department of Housing and Urban Development (HUD). Since 2023, HUD has incorporated the Zillow Observed Rent Index (ZORI) into these estimates, making the voucher program more responsive to current market conditions.

However, finding a suitable housing unit that accepts vouchers remains a challenge. Despite anti-discrimination laws in some regions, many landlords still do not accept vouchers, further complicating the search for affordable housing.

Earlier this year, the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Veterans Affairs (VA), in an effort to help homeless veterans and their families find permanent housing, awarded $14 million in HUD-Veterans Affairs Supportive Housing (HUD-VASH) vouchers to 66 Public Housing Agencies (PHAs) across the country for more than 1,400 vouchers. The HUD-VASH program provides housing and an array of supportive services to veterans experiencing homelessness by combining rental assistance from HUD with case management and clinical services provided by the VA.