With climate change ever present and top-of-mind for many and factoring into the homebuying process, a new study from Dr. Tom Jeffery, Senior Hazard Scientist for CoreLogic Location Science, examines the growing risk of wildfires on U.S. properties and the damage inflicted on homes.

In the report, used as an example is the year 2023, where an El Niño weather pattern brought increased moisture to the West and South regions of the nation. CoreLogic reported that 2,693,910 acres or 4,209 square miles burned in 2023 from wildfires, in contrast to the year 2022, when nearly triple the amount of that area burned, with fires touching 7,577,183 acres or 11,839 square miles (an area approximately twice the size of the state of Connecticut).

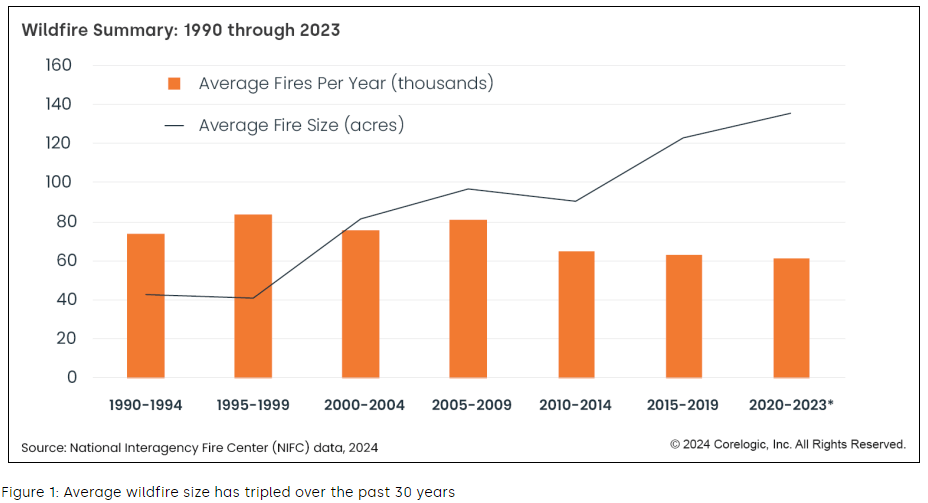

“Only four months into 2024, and already 1.75 million acres have burned in the U.S.,” said Dr. Jeffrey in his report. “This is primarily due to the largest fire recorded in Texas history, which scorched over one million acres. When it comes to predicting wildfire risk, the only certainty is that while the number of fires per year is in decline, the increasing size and intensity of those fires is creating more property damage than ever before.”

Areas most at-risk

Wildfires generally occur in transitional areas between dense development and wildlands. In the U.S., this intersection is home to approximately 45 million residences, a number that continues to grow annually.

“Wildlands” refer to areas that are large, open expanses containing natural vegetation. They are not necessarily remote locations, but are classified as larger expanses of natural vegetation near cities where suburban developments are pushing outward from urban areas.

“While the number of fires per year is in decline, the increasing size and intensity of those fires is creating more property damage than ever before,” added Dr. Jeffrey.

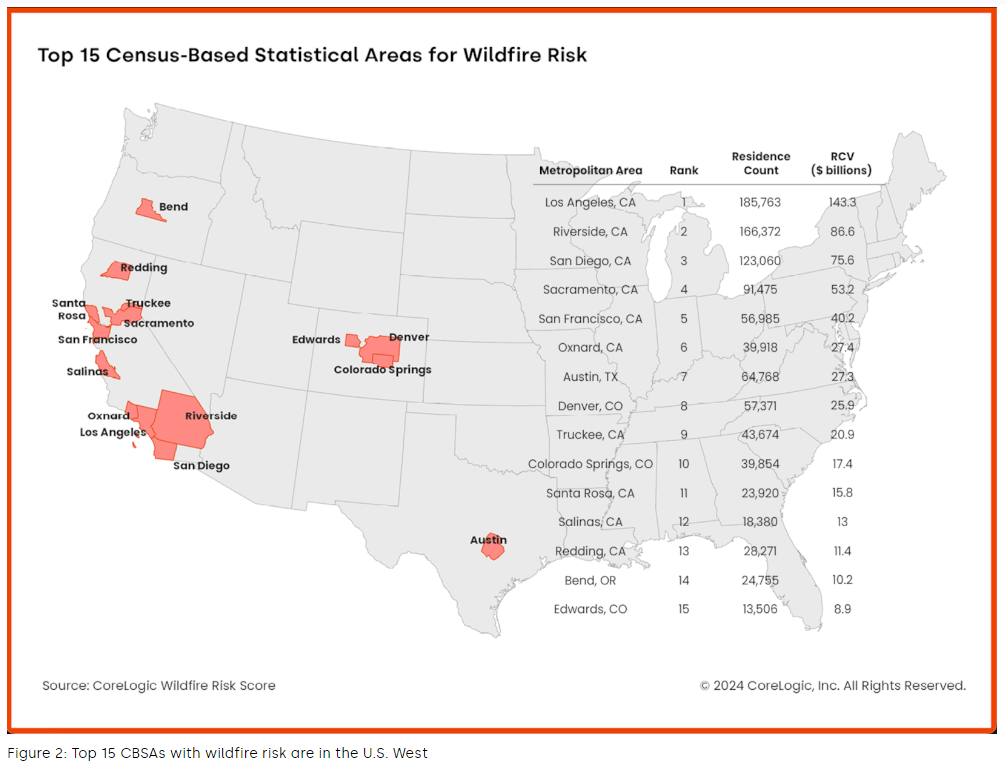

CoreLogic analyzed the nation’s top residential areas exposed to wildfire risk, and measured the reconstruction cost of those properties, and ironically, all were found in the Western United States.

With 185,763 residents found most vulnerable, Los Angeles, California topped the list most at-risk for wildfires, with a Reconstruction Cost Value (RCV) of $143.3 billion. Following in second place was Riverside, California, located in the southern portion of the Golden State, where 166,372 residences were found to be most at-risk of wildfires, with an RCV of $86.6 billion. Rounding out the top 15 with the highest RCV, along with the number of residences in harm’s way, were:

- San Diego, California (123,060 residences)

- Sacramento, California (91,775 residences)

- San Francisco, California (56,985 residences)

- Oxnard, California (39,918 residences)

- Austin, Texas (64,768 residences)

- Denver, Colorado (57,731 residences)

- Truckee, California (43,674 residences)

- Colorado Springs, Colorado (39,854 residences)

- Santa Rosa, California (23,920 residences)

- Salinas, California (18,380 residences)

- Redding, California (28,271 residences)

- Bend, Oregon (24,755 residences)

- Edwards, Colorado (13,506 residences)

Crafting manageable solutions

When climate-related issues strike, learning from past events serves as the most common means to avoid and curb future instances. Judging by the number of U.S. residences at-risk of wildfire, based on location, the reconstruction cost value to replace them is markedly higher. Also of concern is the fact that many of the high-extreme wildfire risk areas are in states that lead the nation in housing shortages.

“The result is that the need for wildfire education, thoughtful urban planning and development, and wildfire insurance coverage that supports risk mitigation has never been greater,” said Dr. Jeffrey.

The study notes that embers were found to be responsible for an estimated 90% of home ignitions caused by wildfire, and there have been instances of embers igniting residences up to a half mile or more from an actual fire.

According to HouseFresh, wildfires are not just a result of increasing heat, but climate-related factors, such as increased droughts and tree-killing beetles, that make woodland regions more susceptible to fire. From 1990-2010, the areas where wildfires were most pronounced experienced 41% growth in the number of houses built (33% growth by area). This made wildfire-prone land “the fastest-growing land use type in the conterminous United States” during that period, according to the study that produced those figures. According to Timothy Collins, a Geography Professor at the University of Utah, “people are drawn to those environments because of the amenities associated with forest resources.”

Preventative measures mount

Redfin recently reported that 51% of California homeowners said they or the area they live in has been affected by rising home insurance costs or changes in coverage (e.g., their insurer dropped them) over the past 12 months. For the analysis, Redfin commissioned a survey by Qualtrics in February 2024, polling 2,995 U.S. homeowners and renters.

According to Redfin, seven of California’s largest property insurers have recently opted to limit new policies in the Golden State amid increasing wildfire risk. Mounting insurance costs and natural disasters are prompting some people to even relocate, as the same survey found that in California, 13.1% of people who intend to relocate in the coming year cited concern for natural disasters or climate risks as a reason, compared to 8.8% of respondents nationwide.

“Homeowners living in areas where insurance premiums are surging are at-risk of seeing their properties gain less value than homeowners in areas with stable premiums—and in some cases, they may even lose money,” said Redfin Chief Economist Daryl Fairweather. “Homes with low disaster risk and low insurance costs will likely become increasingly popular, and thus more valuable, as the dangers of climate change intensify.”

Click here for more on CoreLogic’s report, “Top 15 U.S. Metros With Exposure to Wildfire Risk.”