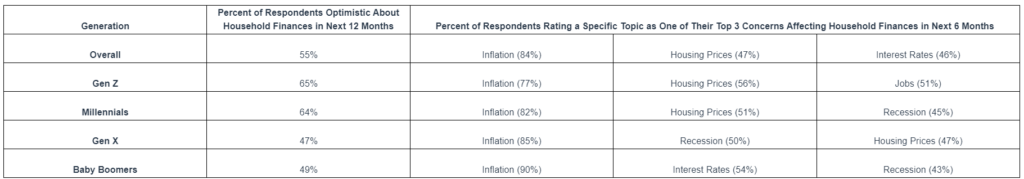

According to credit bureau TransUnion’s Q2 2024 Consumer Pulse study, consumer concerns about inflation and interest rates reached their highest levels in two years despite the fact that 55% of Americans remain optimistic about their household finances over the next year. This number has stayed the same year-over-year from 2022 and 57% in 2023.

This optimism seems largely driven by confidence in a stable employment situation and continued wage increases. The newest Consumer Pulse study is based on a survey of 3,000 American adults that ran between April 29 and May 8, 2024.

Asked to rank their top three concerns that affect respondent’s household finances for the next six months, the study found noted increases in concerns about inflation on household staples such as groceries and fuel (up 5 percentage points to 84%) and interest rates (up 5 percentage points to 46%) year-over-year.

“Consumers are facing distinct challenges when taking into account today’s high inflation and interest rate environment. From filling up a tank of gas to making a rental payment to buying groceries, most consumers are paying more today for everyday expenses than they ever have. And if they’re using a credit card to make these purchases, their interest rates are at much higher levels, so costs also are rising for those consumers carrying a balance,” said Charlie Wise, SVP and Head of Global Research and Consulting at TransUnion. “Despite these challenges, the majority of consumers remain optimistic about their finances. With low unemployment and healthy wage gains, consumers continue to feel good about their future prospects – with the youngest generations leading the way.”

Diving deeper into inflation concerns

The clearest data points from the Consumer Pulse study that inflation remains the greatest boon facing consumers on a daily basis. This is followed by housing prices, which was indicated by 13% of respondents.

The study points to a widening gap between those who say their household incomes are keeping up with inflation versus those who say their incomes are not keeping up. In the second quarter of 2024, 48% of consumers said their incomes were not keeping up with inflation – up from 46% in Q2 2023. At the same time, just 31% agreed or strongly agreed that their incomes were keeping up with inflation – down from 33% one year earlier.

Why is inflation such an issue? Consumers indicated a number of areas where rising prices are of particular concern, including groceries (84%), gasoline (66%) and utilities (55%). The largest quarterly increases in rising price concerns between Q1 and Q2 2024: gasoline for cars (up 11 percentage points) and dining out, take out and meal delivery (up 7 percentage points).

“As the cost of living continues to increase, we are seeing clear behavioral changes, with those being ‘inflation concerned’ more likely to cut back on discretionary spending and cancel subscriptions or memberships, while also being more likely to turn to credit cards to help them through these challenging times,” said Wise.

Impact on credit demand and usage

Individuals turn to unsecured lines of credit—or credit cards—during times of elevated inflation and high consumer interest rates, which sets up an interesting dynamic. Some consumers need more credit to manage their growing expenses, but high interest rates could add more to their debt burdens if they do not pay off their credit products in a timely manner.

The Consumer Pulse study shows that in this dynamic, consumers’ appetite for new credit is winning. Of the 31% of consumers in Q2 2024 who said they plan on applying for new credit or refinancing existing credit within the next year, 59% said they’ll apply for new credit cards in that time period, up from 53% in Q2 2023. As of Q1 2024, consumers hold more than 543 million credit cards—by far the most popular credit product. For the record, the population of the U.S. is only 333.3 million, which means most people have more than one unsecured credit line.

The increased interest in credit cards comes at the same time as more consumers are worried about high interest rates. Nearly two in three consumers (65%) said rising interest rates will moderately or highly impact whether they apply for credit in the next 12 months. As well, the percentage of consumers who said they planned to apply for a mortgage, home equity line or personal loan—credit products that are highly sensitive to interest rates—have all dropped materially from prior year levels.

According to TransUnion,the youngest generations are the most concerned by rising interest rates as it relates to new credit products: 80% of Gen Z and 77% of Millennials said rising interest rates will moderately or highly impact whether or not they apply for credit in the next 12 months. The impact is not as significant for older generations—Gen X at 67% and Baby Boomers at 41%.

“When historians look back at this time years from now, it will be clear to them that the dynamics at play in the current credit market are a direct reflection of the inflationary and high interest rate pressures consumers face today. In our view, the far majority of consumers are meeting the challenges they face today – aided by a strong employment picture. What portends for the remainder of 2024 and into 2025 will likely be dictated by three things: the employment situation, interest rates and inflation,” concluded Wise.

Click here for the report in its entirety.