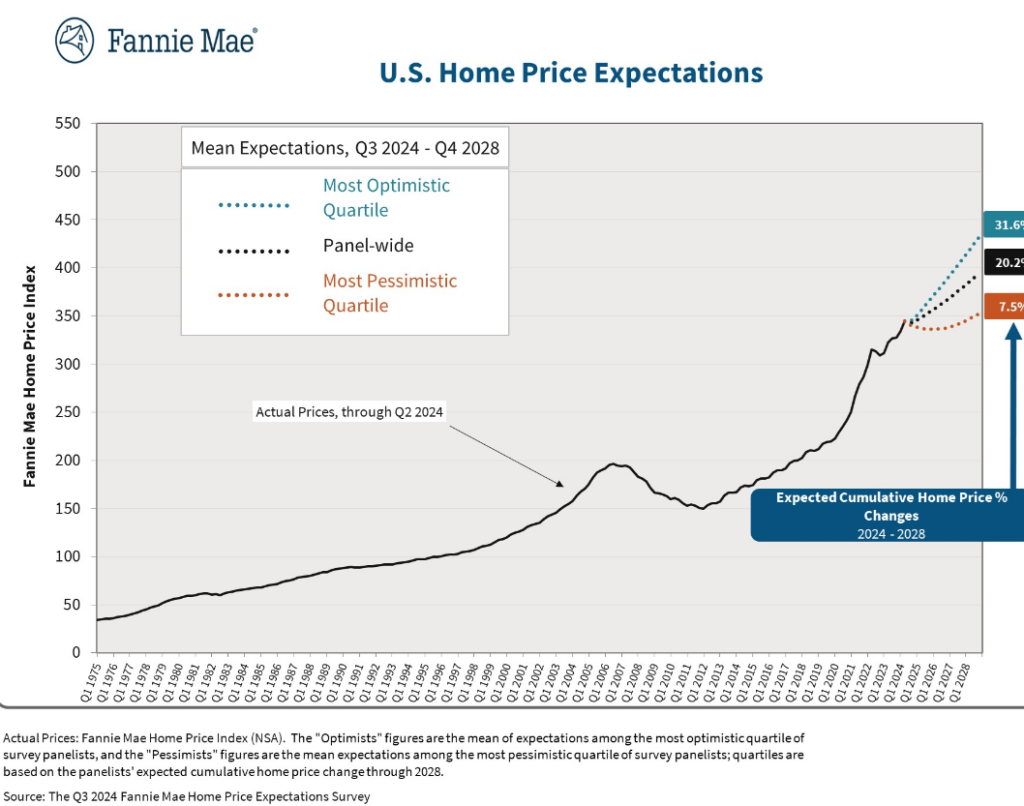

The latest Fannie Mae Home Price Expectations Survey (HPES), produced in partnership with Pulsenomics, examining third quarter 2024 data, has found that following home price growth of 6.0% in 2023, an annual national home price growth of 4.7% is forecast for the remainder of 2024, followed by growth of 3.1% in 2025.

The panel’s latest estimates of national home price growth are higher than last quarter’s expectations of 4.3% for 2024 but lower than the previous quarter’s expectations of 3.2% for 2025.

Terry Loebs, Founder of Pulsenomics, said: “Despite robust home value growth in the first half of 2024, our panelists anticipate a slowdown in price appreciation for the remainder of the year and beyond. While lower interest rates could incentivize some homeowners to sell, the deep-rooted housing supply and affordability crises will likely persist, even with a more accommodative monetary policy.”

Fannie Mae’s HPES polls more than 100 experts across the housing and mortgage industry and academia for forecasts of national home price percentage changes in each of the coming five calendar years, as measured by the Fannie Mae Home Price Index (FNM-HPI).

Strength in Home Price Growth

“Recent measures of home price growth, including our own, have continued to come in stronger than previously expected, as reflected by the 100-plus HPES panelists who, on average, once again modestly upgraded their home price outlook for 2024,” said Mark Palim, Fannie Mae VP and Deputy Chief Economist. “Strong home price appreciation has persisted despite purchase affordability remaining stretched for the vast majority of consumers, a dynamic that is still primarily a function of inadequate supply. Our panelists overwhelmingly agreed that there is a fundamental lack of housing in the United States relative to underlying demographic factors–and, on average, believe the nation to be short approximately 2.8 million homes. We’ve previously estimated the shortfall to be more than four million. The panelists also shared that they think speeding up construction permitting processes, increasing density around transit corridors, and allowing more “missing middle’-type housing are the local and state policy reforms likeliest to increase housing production. However, most remain apprehensive about the near-term prospects of these sorts of reforms being enacted broadly enough to have a meaningful effect on supply and housing affordability.”

Gauging a Cyclical Housing Market

While affordability issues still plague many prospective home buyers, impacted by a phenomenon called the “lock-in effect,” where mortgage rates are prompting many to stay put instead of selling and buying another home at a higher rate. A recent study by Redfin found that 85.7% of U.S. homeowners with mortgages have an interest rate below 6%, down from 90.6% at the start of last year, and a record high of 92.8% in mid-2022. This means even more than 85.7% of homeowners with mortgages have a rate below the current weekly average of 6.46%, prompting many to stay put and remain “locked-in” to their current rate.

“I have a dozen or so homeowners who would like to sell, but aren’t willing to give up their 3% interest rate for one that’s more than twice as high,” said Blakely Minton, a Redfin Premier Real Estate Agent in Philadelphia. “Many of those sellers will list if rates get back down to 5%.”

Expected actions by the Federal Reserve to cut rates has driven down the 30-year fixed-rate mortgage (FRM) of late, as Freddie Mac reported in its latest Primary Mortgage Market Survey (PMMS) that the FRM averaged 6.35% as of August 29, 2024, down week-over-week when it averaged 6.46%. A year ago at this time, the 30-year FRM averaged 7.18%.

The dip in rates has forced a slight increase in overall mortgage application volume, as the Mortgage Bankers Association (MBA) reports in its latest Weekly Applications Survey for the week ending August 30, 2024 that mortgage applications increased 1.6% from one week earlier.

“August closed on a strong note, with mortgage applications increasing 3%, and up for the fourth time in five weeks,” said MBA President and CEO Robert D. Broeksmit, CMB. “Borrower demand is returning now that rates are at lows last seen in April 2023. With an expected short-term rate cut from the Federal Reserve later this month, MBA expects mortgage rates to continue to decrease, albeit at a slow pace.”

The Impact on Housing Supply

For Q3, Fannie Mae’s Economic & Strategic Research (ESR) Group, led by SVP and Chief Economist Douglas G. Duncan, also surveyed panelists on the impact of potential zoning and permitting reforms at state and local levels to increase construction of new homes and, thereby, the supply of homes available to buyers and renters.

While most panelists believe that reforms implemented to date are likely to have a positive effect on new construction within the next five years, they were generally split on whether that effect would be “moderate” or “insignificant.” A plurality of panelists suggested that hastening the construction permitting process would have the greatest positive impact on housing supply if broadly enacted, following by expanding zoning for multifamily housing developments and enabling more “missing middle” or “light touch density” housing construction. However, 63% of panelists are “not confident at all” that the initiatives they think would be most effective will be enacted widely within the next five years.

HouseCanary Inc.’s latest August Market Pulse Report found that the nation’s housing inventory remains low from a historical perspective, however, is now at the highest level reported since Covid. HouseCanary previously reported that inventory levels were gradually approaching pre-Covid levels, and this sentiment remained unchanged in August as total inventory increased 28.7% from the same period last year. Additionally, contract volume in August 2024 across all price tiers increased compared to August 2023, suggesting a steadier housing market and evidence of demand from potential homebuyers, further demonstrating a seller’s market.

Jeremy Sicklick, Co-Founder and CEO of HouseCanary, commented: “The past couple of years have seen a housing shortage nationwide. However, consistent with what we have seen throughout this summer, there have been signs pointing to normalization in the housing market since the pandemic when looking at inventory levels, pricing, and contract volumes from a multiyear perspective. Notably, total inventory is up 28.7% from the same period in 2023, and up 9.3% from 2022, indicating improvements in the pool of available properties and an eventual neutralization of the housing market.

Click here for more on the latest Fannie Mae Home Price Expectations Survey (HPES).