According to the Realtor.com February Monthly Housing Report, the percentage of homes with price reductions increased to 16.8% from 14.6% in February of previous year, indicating that sellers are becoming more accustomed to the present market conditions. The number of newly listed homes grew 4.2% over the previous year, making 2019 February the most active month for sellers since 2021.

“While rates remain elevated, we are beginning to see green shoots in the market as sellers grow tired of waiting for significant changes in interest and mortgage rates,” said Danielle Hale, Chief Economist at Realtor.com. “If these trends continue for the next few months, we could see a market that is entering into more balanced terrain, with rising inventory and a potential future slowdown in price growth. While the market does not look like it did before the pandemic, we are moving away from the ultrahigh demand, low inventory period we saw in 2021 and 2022.”

Key Findings:

- Newly listed homes increase 4.2% year-over-year, slightly slower than January’s pace

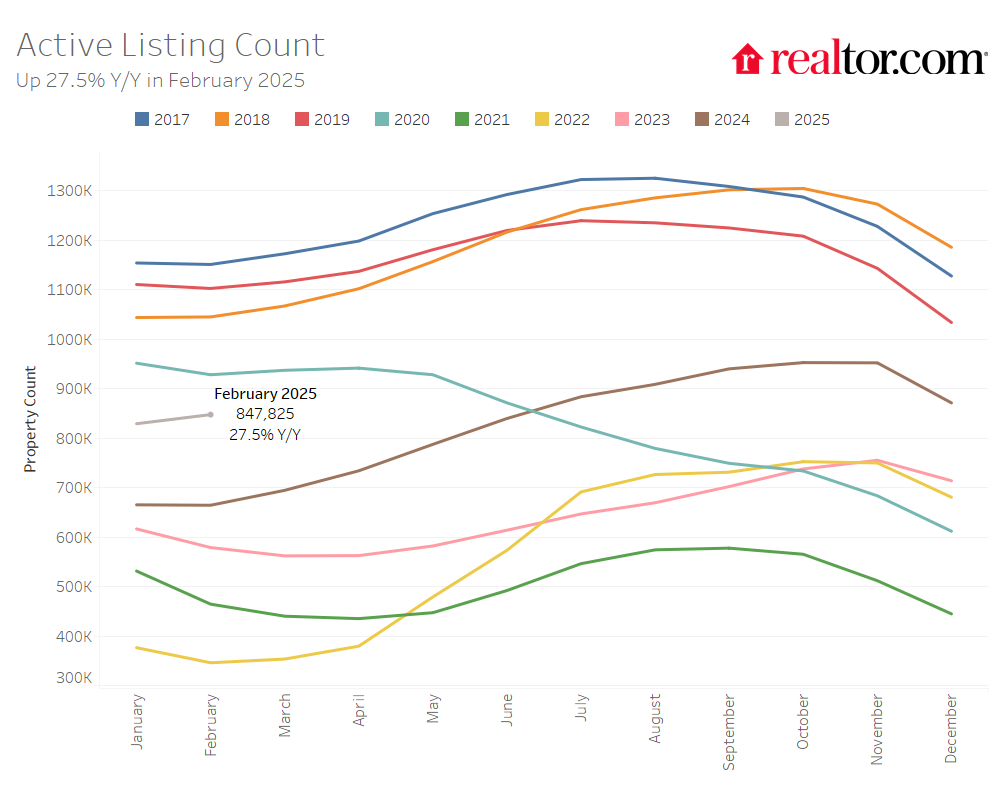

- Homes actively for sale increase 27.5% compared with last year

- Impact of the recent turmoil within the Federal workforce is not yet apparent in housing data

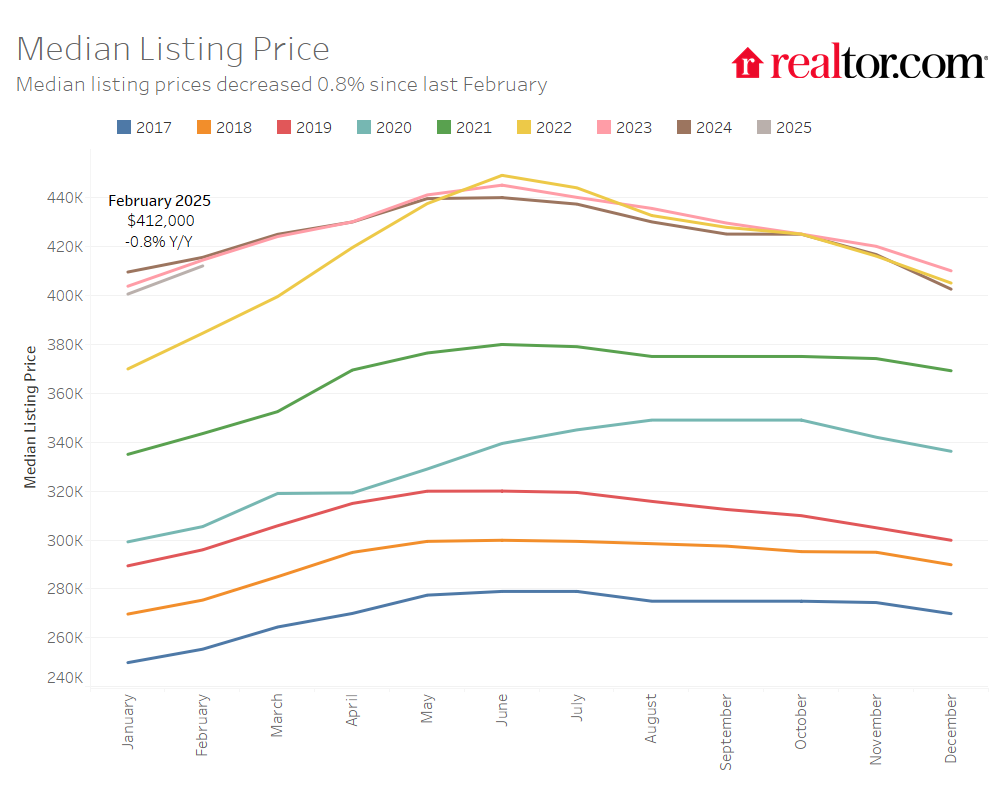

The median home listing price in February dropped to $412,000, below the previous year’s level. Sellers also listed their homes at higher rates than the previous year, with the number of newly listed homes rising 4.2% annually. Because there were more smaller properties listed this year, the median list price was lower than it was the previous year.

Data from this month’s research indicates that, despite a surge in interest, there is currently no discernible link between the markets with a strong government personnel and those that are going through the biggest slowdowns. These markets have not demonstrated any noteworthy patterns in terms of rising inventory, lengthening time on market, or decreasing or softening pricing as of February. This is to be expected at this time, given the recent changes in the workforce, and it doesn’t rule out future repercussions.

February 2025 Housing Metrics — National

| Metric | Change over Feb. 2024 | Change over Jan. 2019 |

| Median listing price | -0.8% (to $412,000) | +39.2 % |

| Active listings | +27.5 % | -23.1 % |

| New listings | +4.2 % | -13.7 % |

| Median days on market | +5 days (to 66 days) | -9 days |

| Share of active listings with price reductions | +2.2 percentage points(to 16.8%) | +1.2 percentage points |

| Median List Price Per Sq.Ft. | +1.2 % | +54.8 % |

How Federal Unemployment May Affect the U.S. Housing Market

The state of the local labor market is frequently linked to the state of the local housing market. The extent to which federal workforce reductions affect housing markets with a large concentration of government workers will probably depend on how well the private sector is doing in these areas and how well it can offer new opportunities.

Currently, these areas’ housing situations are not all that different from those in other markets. Any significant impact is probably ahead, as previous research from Realtor.com indicates that the average house seller takes at least two weeks, and frequently more, to prepare a home for sale.

In keeping with the national trend, price reductions in the Washington, D.C., region rose by 2.3 percentage points from February of last year, putting it in the center of the list of metro areas with the biggest price reduction increases, at number 23. In terms of price decreases, the metro has ranked 21st, and the median list price per square foot has also decreased year-over-year. Interestingly, Washington, D.C.’s percentage of price cuts has increased every week in February, indicating that as the spring market develops, wider effects might become more noticeable. As the market continues to move, buyers and sellers in the area might want to keep a careful eye on trends.

Additionally, homes are remaining on the market for longer periods of time; February 2025 is the eleventh consecutive month in which this has happened. On average, February homes were on the market for 66 days, which is an estimated 11 days less than the average for February of 2017–2019. With an average increase of seven and eight days on market, respectively, the South and Midwest experienced the largest regional increases in time on market this month.

Western Regions See Uptick in Newly-Listed Homes

New listings in the West increased by 14.4% over the previous year, but those in the South only increased by 3.7%, while those in the Midwest and Northeast decreased by 3.2 and 3.4%, respectively. In the South, newly listed residences were just 5.8% below pre-pandemic levels, the smallest difference between pre-pandemic 2017 and 2019 levels. In contrast, they fell 34.6% in the Northeast, 15.7% in the West, and 20.5% in the Midwest.

Of the 50 largest metro areas, 35 experienced an increase in new listings in February compared to the same month last year, while 42 witnessed a decrease. Compared to the average pace of new listings from February 2017 to 2019, only eight major metro areas experienced more newly listed houses this February, including San Antonio, Houston, and Jacksonville, FL. Compared to six major metros the previous month, this represents an increase. The metro areas with the biggest increases in newly listed properties over the previous year were Los Angeles (+27.1%), San Francisco (+27.2%), and San Jose, CA (+28%).

February 2025 Statistics — Regional

| Region | Active Listing Count YoY | New Listing Count YoY | Median Listing Price YoY | Median Listing Price Per SF YoY | Median Days on Market Y-Y (Days) | Price-Reduced Share Y-Y (Percentage Points) |

| Midwest | 18.7% | -3.2% | -0.2% | 1.6% | 8 | +1.2 pp |

| Northeast | 9.2% | -3.4% | 0.0% | 2.9% | 2 | +0.2 pp |

| South | 29.9% | 3.7% | -2.0% | -0.1% | 7 | +2.1 pp |

| West | 37.4% | 14.4% | -1.2% | 0.9% | 4 | +3.5 pp |

Compared to the previous year, residences in the Midwest are now on the market for eight more days, while those in the South, West, and Northeast are up seven, four, and two days, respectively. In all four locations, time on the market was at or below pre-pandemic levels, even if it was higher than it was the previous year. Homes in the West remained on the market for the same length of time as the average for February 2017–19. They spent 8 days less in the South, and homes are still moving at far faster rates than they did before the epidemic in the Midwest and Northeast, which are 19 and 24 days less, respectively.

While time on the market decreased somewhat from 43 markets last month, it grew in 42 of the 50 largest metro areas this February compared to last year. Portland saw the biggest rise (+21 days), followed by Nashville, TN, Atlanta, and Jacksonville, FL, which were equal at 16 additional days. Homes in 19 markets stayed on the market longer than the average pre-pandemic 2017–19 timing, with Portland, OR (+31 days), Buffalo, NY (+15 days), and Denver (+14 days) being the most notable exceptions.

To read the full report, including more data, charts, and methodology, click here.