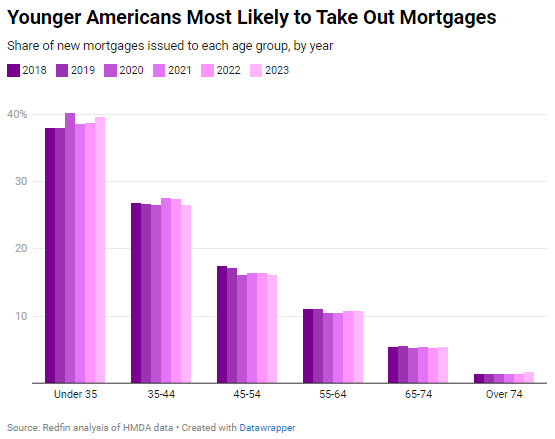

Two-fifths (39.7%) of new mortgages issued in 2023 went to homebuyers under 35, with 26.5% going to buyers aged 35 to 44. The 45-54 age group took out 16.1% of new mortgages, followed by the 55-64 age group (10.8%) and the 65-74 age group (5.4%). This is according to new research from Redfin.

Over the previous five years, the age mix of homebuyers has remained constant, with younger Americans accounting for the majority of mortgage borrowers. As people get older, they are less likely to take out a mortgage.

Per the report, there are multiple reasons why people under 45 are taking out most mortgages, including:

- Gen Zers and millennials are aging into homeownership; the median age of first-time U.S. homebuyers is 35. People tend to be in their late 20s or 30s when they buy their first home because that’s when homeownership becomes financially feasible and desirable: They’ve had time to save for down payments and qualify for mortgages, and they may be growing their families.

- Many people view real estate as a safer long-term place to park their money than the stock market or other traditional investments.

- Younger buyers are likely to take out loans rather than pay for homes in cash because they haven’t had much time to amass wealth and/or build equity from the sale of a previous home. Older buyers are more likely to pay in cash.

“First-time buyers aren’t as spooked by high rates as people who are trying to move up to a bigger or better home,” said Antonia Ketabchi, a Redfin Premier agent in Maryland. “High costs are still a challenge, but younger people are excited about the fact that they’re looking to buy their first home, and they’re not locked in by a low mortgage rate because until now they’ve been renting. Plus, they weren’t in the market three years ago when mortgage rates were sitting under 3%, so they don’t have an ultra-low point of comparison.”

Although Gen Zers and millennials were the most likely to purchase a home last year, they still have lower overall homeownership rates than older Americans, which is understandable given that they have had less time to do so. In 2023, just more than a quarter (26%) of adult Gen Zers owned their homes, whereas 55% of millennials did. In contrast, 72% of Gen Xers and 79% of baby boomers own their homes. However, Gen Zers are catching up to older generations: 19-25 year olds own more homes than millennials and Gen Xers did at the same age.

Some Gen Zers, Millennials Get Financial Help from Family

Some young homeowners received financial assistance from their parents or other elderly family members to fund their acquisitions. In 2023, 3.3% of homeowners under the age of 35 had a co-borrower over the age of 55 on their mortgage loan, compared to 2.8% for buyers aged 35 to 44.

When cash presents are considered, the percentage of young purchasers who receive financial assistance from their parents increases significantly. According to a Redfin-commissioned poll conducted in February 2024, more than one-third of Gen Zers and millennials planning to buy a home expect to receive a monetary gift from relatives to help fund their down payment.

Buyers Under 35 Take Out Nearly Half of all Mortgages in Some Rust Belt Metros

In 2023, Gen Z and young millennial homeowners accounted for the majority of mortgage activity in relatively affordable Rust Belt metros. Pittsburgh provided 48% of new mortgages to buyers under the age of 35, the highest percentage among the 50 most populous U.S. metros. It is followed by Cincinnati (46.5%), Philadelphia (46.3%), Detroit (46.1%), and Warren, Michigan (46%).

Buyers under 35 accounted for the smallest share of the mortgage pie in prominent Florida retirement resorts, where populations are typically older: West Palm Beach issued 27.8% of new mortgages to those under 35 last year, the least share of any metro in this survey, followed by Fort Lauderdale (28.8%). Anaheim, CA (31.7%) is followed by Orlando, FL (32%) and Las Vegas (32.9%).

The scenario is much different for older millennials, who took out the majority of mortgages in the Bay Area. In San Francisco, 37.8% of new mortgages issued last year went to people aged 35 to 44, the highest share of any metro in this analysis, followed closely by Oakland (37.2%) and San Jose (37.1%). Next are Newark, NJ (34.5%) and Los Angeles (34.5%).

One reason older millennials are more likely to take out mortgages in the Bay Area than in other parts of the country is that it is extremely costly, with many people purchasing their first house in their late thirties and early forties.

People of all generations bought much fewer homes in 2023 than the previous year, as rising housing prices and mortgage rates reduced buyers’ budgets; 2023 was the least cheapest year on record. However, historically low inventory has also hampered sales.

To read the full report, including more data, charts, and methodology, click here.