After increasing in December 2024—which showed the Mortgage Credit Availability Index (MCAI) rose by 0.7% to 96.6—the MCAI, a survey from the Mortgage Bankers Association (MBA) that examines data from ICE Mortgage Technology, shows that mortgage credit availability also ticked up in January.

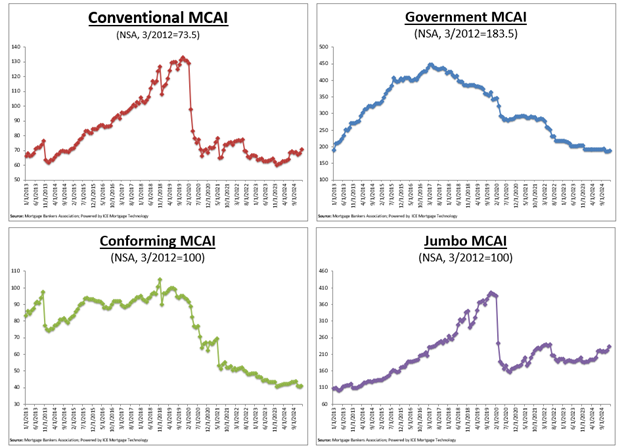

In January, the MCAI increased by 2.5% to 99%. While an increase in the index signifies loosening credit, a decrease in the MCAI suggests tightening lending rules. In March 2012, the index was benchmarked at 100. While the Government MCAI climbed by 1%, the Conventional MCAI increased by 3.8%. The Conforming MCAI increased by 0.5%, while the Jumbo MCAI increased by 5.3% among the Conventional MCAI’s component indices.

“Credit availability increased to start 2025, driven by conventional credit supply rising to its highest level since June 2022,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “There were expanded loan offerings for cash-out refinances, along with more jumbo and non-QM loan programs. Although similar to last month, these were limited to borrowers with better credit. All other subindexes saw increases in January, a positive development for the spring homebuying season, if these trends continue.”

Key Highlights — Conventional, Government, Conforming & Jumbo Indices

In January, the MCAI increased by 2.5% to 99. While the Government MCAI climbed by 1%, the Conventional MCAI increased by 3.8%. The Conforming MCAI increased by 0.5%, while the Jumbo MCAI increased by 5.3% among the Conventional MCAI’s component indices.

Using the same technique as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to demonstrate the relative credit risk and availability for their respective indices. The population of loan programs that are examined is the main distinction between the Component Indices and the entire MCAI.

While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks at FHA, VA, and USDA loan programs. FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are a subset of the standard MCAI. Conventional lending programs that come inside conforming loan limitations are examined by the Conforming MCAI, whereas conventional programs outside of conforming loan limits are examined by the Jumbo MCAI.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

To read the full report, including more data, charts, and methodology, click here.