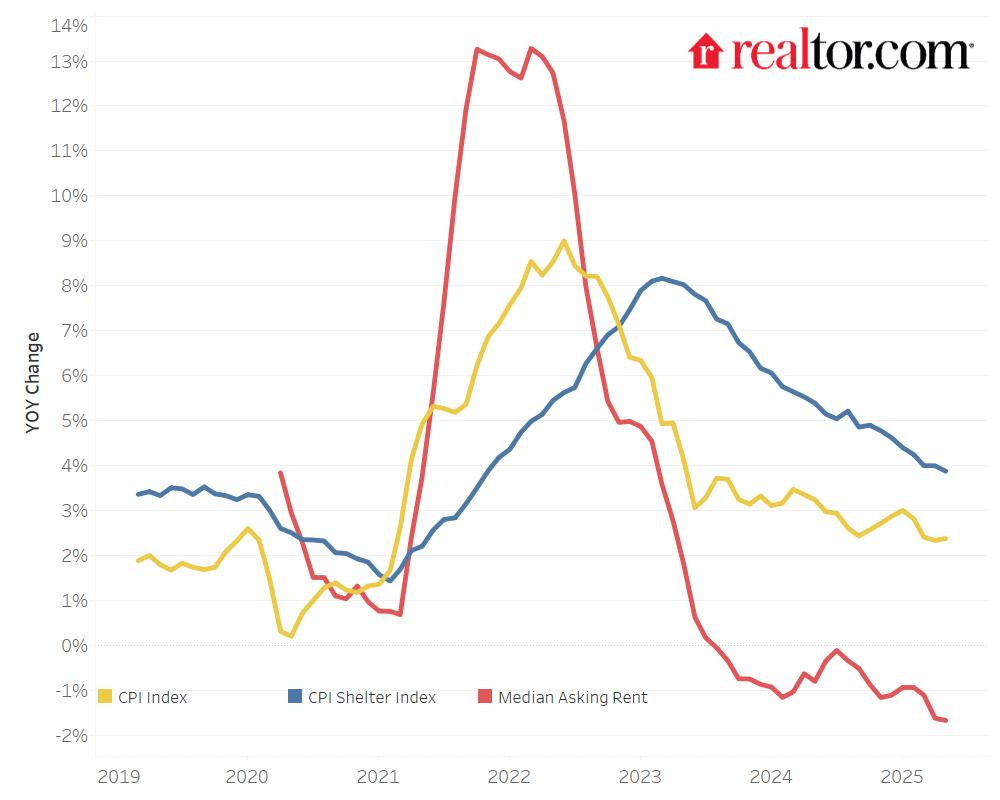

According to the Realtor.com May Rent Report, although rents in the U.S. are still higher than they were before the pandemic, their growth over the last six years has not kept pace with both overall inflation and home prices. The median rent was $1,705 as of May 2025, up 19.6% from the same period in 2019—less than the 25.6% increase in consumer prices. In the coming months, Americans may anticipate additional relief from shelter inflation as market-based rents continue to decline.

An important perspective for affordability is provided by comparing metro-level rent increase to U.S. inflation, which shows where local housing expenses are increasing more quickly than the cost of living for residents as a whole. Only nine metropolitan areas—Indianapolis, Jacksonville, FL; Kansas City, MO; Miami; New York; Pittsburgh; Sacramento, CA; St. Louis; and Tampa, FL—have seen rent increases that have above inflation since 2019.

“Falling median asking rents are an encouraging sign that relief is on the way for shelter inflation,” said Danielle Hale, Chief Economist at Realtor.com, “which has been one of the largest contributors to elevated consumer prices.”

Metros Where Rent Is Outpacing Overall Inflation Over the Past Six Years

| Metro | Median Asking Rent (0-2 bedrooms) | Six Year Change |

| Pittsburgh, PA | $1,466 | 43.2 % |

| Tampa-St. Petersburg-Clearwater, FL | $1,736 | 41.6 % |

| Miami-Fort Lauderdale-West Palm Beach, FL | $2,350 | 36.2 % |

| Indianapolis-Carmel-Greenwood, IN | $1,295 | 32.1 % |

| Kansas City, MO-KS | $1,394 | 31.3 % |

| Sacramento-Roseville-Folsom, CA | $1,878 | 29.2 % |

| New York-Newark-Jersey City, NY-NJ | $2,902 | 28.7 % |

| Jacksonville, FL | $1,512 | 27.2 % |

| St. Louis, MO-IL | $1,338 | 26.8 % |

Median rents are below inflation in the majority of major U.S. metro areas. The largest difference in comparison to inflation was observed in San Francisco, CA, where rents have decreased by 3.2% since 2019. Minneapolis, followed by Oklahoma City (7.7%), Seattle, WA (7.9%); Denver (8.9%); and San Jose, CA (8.9%).

“Because shelter costs tend to lag behind real-time market trends, the sustained slowdown in rent growth is likely to show up in the Consumer Price Index in the months ahead, helping to ease overall inflation pressure,” Hale said. “While this is an encouraging sign, for most major U.S. metros rents are still considerably higher than before the start of the pandemic, and despite 22 consecutive months of year-over-year declines, the U.S. median rent was just $54 less than the peak seen in August 2022.”

Policy Shifts Reshaping Rental Trends Across U.S.

Nationwide rental markets are changing as a result of recent changes in government policy. Rental demand is anticipated to decline in international student hotspots including San Jose, CA; Miami; Boston; Seattle, WA; and Orlando, FL, as a result of new limits on foreign student visas, which include suspensions of enrollment at universities like Harvard and a halt on new interviews.

Rents in San Jose, CA, Boston, MA, and Seattle, WA—markets with a large concentration of foreign students and close linkages to the skilled talent workforce—are predicted to decline as a result of restrictive international student rules.

In four of the five areas, rents have decreased year-over-year (YoY), indicating that these metros are already cooling. The markets with the highest shares of international students were:

- Miami (-2.7%)

- Seattle, WA (-2.3%)

- Orlando, FL (-1.1%)

- Boston (-0.4%)

Rents by Unit Size — National Averages

| Unit Size | Median rent | Rent YoY | Consecutive months of decline | Total decline from peak | Rent change: 6 years |

| Overall | $1,705 | -1.7% | 22 | -3.2% | 19.6% |

| Studio | $1,418 | -1.9% | 21 | -4.8% | 15.7% |

| 1-Bedroom | $1,582 | -2.3% | 24 | -4.6% | 18.0% |

| 2-Bedroom | $1,896 | -1.7% | 24 | -3.3% | 21.3% |

Changes in the workforce are also having an effect on rental markets linked to federal employment. In May, rental rents in metro areas with significant federal employee concentrations remained contrasting. Further, rents increased somewhat in places like Washington, D.C. (1.3%) and Baltimore (0.3%), but decreased in other federal hubs, including San Diego (-5.9%), Virginia Beach, VA (-2.5%), and Oklahoma City (-1.0%). These conflicting findings highlight the intricate relationship between local housing demand and government employment, reflecting the push-pull impacts of federal job cuts and return-to-office mandates.

Future rents are anticipated to rise as a result of recent tariff increases. Construction costs are rising due to steel and aluminum tariffs, which have already risen to 50%. This is particularly true in metro areas like Columbus, Ohio; Memphis, TN; and Milwaukee, which experienced a spike in multifamily permits in 2024.

While Columbus, Ohio, saw a modest 0.2% growth, as of May 2025, four of these key metros saw YoY rent declines:

- Milwaukee (-0.5%)

- Oklahoma City (-1.0%)

- Cleveland (-1.9%)

- Memphis, TN (-3.3%)

The problem has gotten even more difficult, though. U.S. import duties on steel and aluminum have increased to 50% for almost all nations from June 2025. Rents are predicted to rise further as a result of these growing material costs since developers may decide to halt building or raise rents.

It may take some time for these extra expenses to be completely reflected in rents, as the average period to finish a multifamily structure after authorization is 19.9 months, according to Realtor.com research. Nonetheless, early-stage building indicators, such multifamily permits and starts, may show early effects as early as the upcoming months. In order to fully evaluate the effects of rising tariffs, analysts and consumers in the United States will keep an eye on developments in these susceptible areas.

To read more, click here.