A new analysis of trends in VA loans has found that Generation Z veterans are increasingly using VA loans to buy and refinance homes.

The analysis, conducted by Veterans United Home Loans and based on Department of Veterans Affairs (VA) lending data from the first half of fiscal year 2025, found that total VA loan volume is up 45% compared to the same period in 2024. VA purchase loans are up nearly 10%, while refinance activity of VA loans has surged nearly 150%.

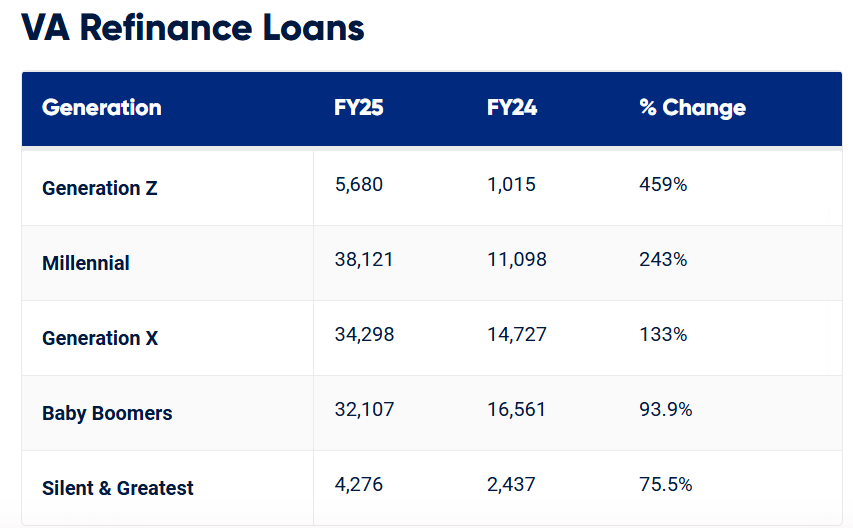

Gen Z veterans and servicemembers led all age demographics in half-year over half-year growth, including a 459% increase in VA refinance loans. The spike in refis could reflects the wave of first-time homeowners capitalizing on an improved rate environment compared to just a year or two ago.

The youngest generation of homebuyers now claims a record-high 12% share of the VA purchase market, triple their share from just three years ago. For comparison, Gen Z buyers comprised only 3% of the overall mortgage market last year, according to the National Association of Realtors (NAR) Home Buyers and Sellers Generational Trends Report.

“This kind of momentum shows just how powerful the VA loan benefit continues to be,” said Chris Birk, VP of Mortgage Insight at Veterans United Home Loans. “Young veterans are stepping into the market with confidence, and this program is helping them overcome hurdles that might otherwise sideline their homebuying journey.”

NAR notes that Gen Z home buyers are entering homeownership with the lowest household incomes, and are unlikely to be married yet or to have children under the age of 18 in their home. Like younger millennials, Gen Z buyers are purchasing older homes than other buyers.

Veterans United’s study found that millennials still dominate VA lending, accounting for nearly half (48%) of all VA purchase loans and 35% of all VA loans since Fiscal Year 2019, according to VA data. Despite the market share held by millennials, Gen Z buyers are starting to make an impact on housing markets nationwide. Last year, when overall VA purchase lending was down 7% compared to 2023, Gen Z was the only age demographic to see an increase.

The study found that Gen Z buyers are most concentrated near large military communities like San Antonio, Texas; Virginia Beach, Virginia; and Colorado Springs, Colorado, where many are purchasing their first homes soon after separation, or while still serving.

“We’ve seen Gen Z veterans embrace the VA loan program in record numbers,” added Birk. “They’re savvy, mission-oriented buyers who understand the value of a 0% down mortgage, especially in today’s market. This generation is on the cusp of playing a major role in shaping the housing economy of the future.”

Bringing VA Benefits to the Forefront

As many vets embark on the journey to homeownership, reportedly, only 10%-15% of eligible veterans report actually utilizing VA home loans, and in some states, that total is as low as 6%.

In order to remedy that situation, Sens. John Boozman and Chris Van Hollen recently announced the introduction of the Veterans Affairs Loan Informed Disclosure (VALID) Act of 2025, a measure geared toward increasing the awareness and utilization of VA home loan benefits, and endorsed by the Veterans Association of Real Estate Professionals (VAREP), Broker Action Coalition, and NAR. According to Sens. Boozman and Van Hollen, providing potential homebuyers with a side-by-side comparison of conventional, Federal Housing Administration (FHA) and VA home loans, the VALID Act would ensure that veterans are properly equipped with financing options that includes their eligibility for homebuying assistance.

The VALID Act would:

- Update FHA mortgage disclosures to include VA home loans alongside FHA and conventional loan options; and

- Ensure that lenders are provided with important information regarding applicant’s military service so they can provide information about VA loans early in the homebuying process.

“We should make certain veterans are aware they qualify for help with purchasing a home or realizing more savings over the life of a mortgage,” said Sen. Boozman, a Senior Member of the Senate Veterans’ Affairs Committee. “Since we know VA home loans are underutilized, there is a clear need to better identify this assistance earlier in the process. I am proud to join my colleagues in enhancing this earned benefit for our former servicemembers.”

Reps. Brittany Pettersen, Young Kim, Nikema Williams, and Harriet Hageman have introduced a companion bill in the U.S. House of Representatives.

“Veterans put their lives on the line to protect our freedoms and, at the very least, deserve to know the benefits available to them. Anything less is unacceptable,” said Sen. Kim. “The VALID Act fully discloses the VA loan options available for veterans to use when buying a home. I’m proud to help lead this commonsense, bipartisan bill that ensures we have the backs of our brave men and women who had ours against global threats.”

Click here for more on the Veterans United Home Loans’ study on trends in VA home loans.