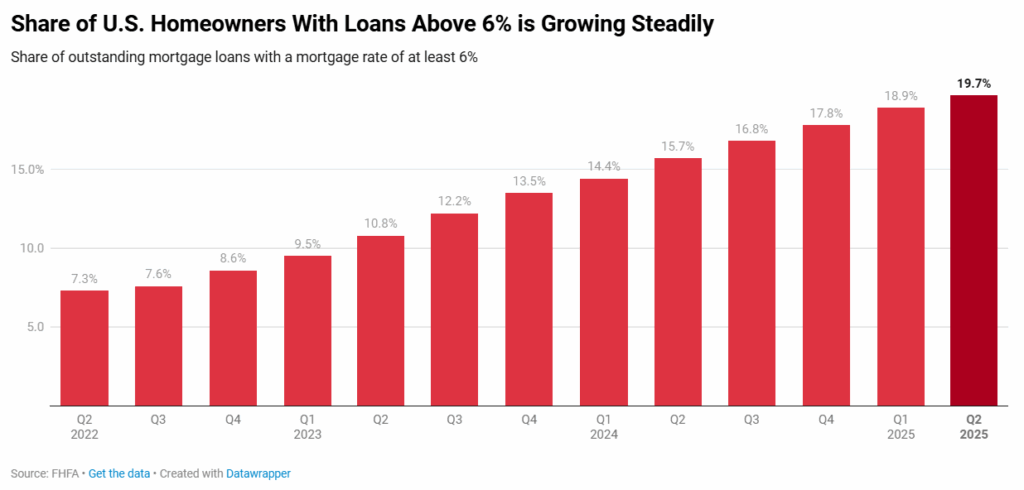

According to a new study by Redfin, the share of mortgaged U.S. homeowners with a rate of at least 6% rose to 19.7% in Q2 of 2025, the highest level since 2015. And with the weekly average mortgage rate fluctuating above 6% since September 2022, that share is growing steadily—rising between 0.8ppts and 1.4ppts each quarter for the past two years.

For the analysis, Redfin examined data from the Federal Housing Finance Agency’s National Mortgage Database through Q2 2025, the most recent period for which data is available.

Mortgage rates have moved between 6%-7% for most of 2025, reaching a low of 6.13% last month ahead of the Federal Reserve’s interest-rate cut. As of Friday, mortgage rates had risen back to 6.38%, and Redfin economists expect rates to remain in the 6%-7% range over the next year.

Many took advantage of historically low mortgage rates during the 2020-2022 pandemic housing boom, with existing home sales climbing to the highest level in more than a decade and at least one-third of mortgages being refinanced. That led to the post-pandemic “lock-in effect,” where homeowners chose to stay put instead of buying another home at a much higher rate.

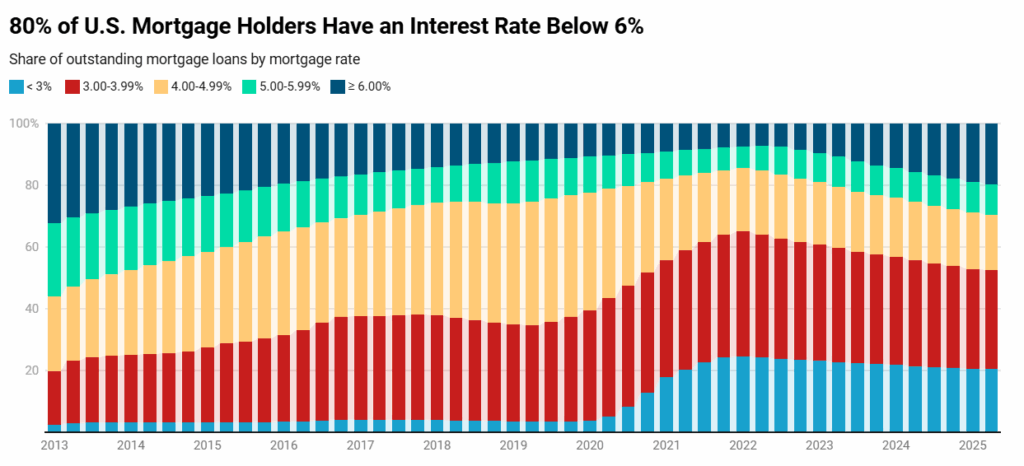

However, homebuyers are growing accustomed to an elevated rate environment, with the share of sub-3% mortgages dropping to 20.4% in Q2, down from a peak of 24.6% in Q1 of 2021, as the share of mortgages with a rate below 6% has dropped to 80.3%, down from 92.7% three years ago.

“More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate,” said Chen Zhao, Redfin’s Head of Economics Research. “Life doesn’t stand still—people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate. As a result, more homes are hitting the market than we’ve seen in years, giving buyers a wider range of choices.”

The increase in homes for sale and recent dip in rates, however, has not yet led to a major uptick in sales—with buyers remaining on the sidelines.

“A lot of people want to buy and they’re just hanging around waiting,” said Mariah O’Keefe, a Redfin Premier Real Estate Agent in Seattle. “Rates have not gone down significantly enough to move the needle—prospective buyers need to see a bigger difference in their potential monthly payment before things are going to change. If rates tick down below 6%, that will bring a lot of people back into the market.”

Key Takeaways

Here is the full breakdown of where today’s homeowners fall on the mortgage-rate spectrum:

- Below 6%: 80.3% of mortgaged U.S. homeowners have a rate below 6%, down from a record 92.7% in the second quarter of 2022.

- Below 5%: 70.4% have a rate below 5%, down from a record 85.6% in the first quarter of 2022.

- Below 4%: 52.5% have a rate below 4%, down from a record 65.1% in the first quarter of 2022.

- Below 3%: 20.4% have a rate below 3%, down from a record 24.6% in the first quarter of 2022.

- Greater than or equal to 6%: 19.7% of mortgaged homeowners have a rate greater than or equal to 6%, the highest share since Q4 2015.

- 5%-5.99%: 9.5% have a rate of 5%-5.99%, the lowest share since Q3 2024.

- 4%-4.99%: 17.9% have a rate of 4%-4.99%, the lowest share in records dating back to 2013.

- 3%-3.99%: 32.1% have a rate of 3%-3.99%, the lowest share since Q3 2019.

- Below 3%: 20.4% have a rate below 3%, the lowest share since Q2 2021.

Click here for more on Redfin’s examination of the nation’s mortgage rate environment.