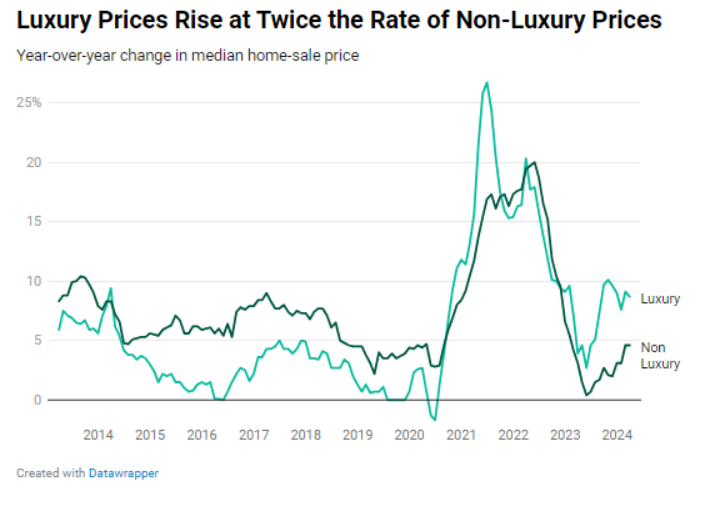

A new analysis of Q1 2024 luxury home sales by Redfin has found that the median-priced U.S. luxury home sold for a record $1,225,000 in Q1, up 8.7% from a year earlier. Prices of non-luxury homes rose at roughly half the pace—up 4.6% to a median of $345,000, also a record high.

For the study, Redfin classified luxury homes as those estimated to be in the top 5% of their respective metro area based on market value, and non-luxury homes as those estimated to be in the 35th-65th percentile based on market value.

Why the rise in luxury home prices?

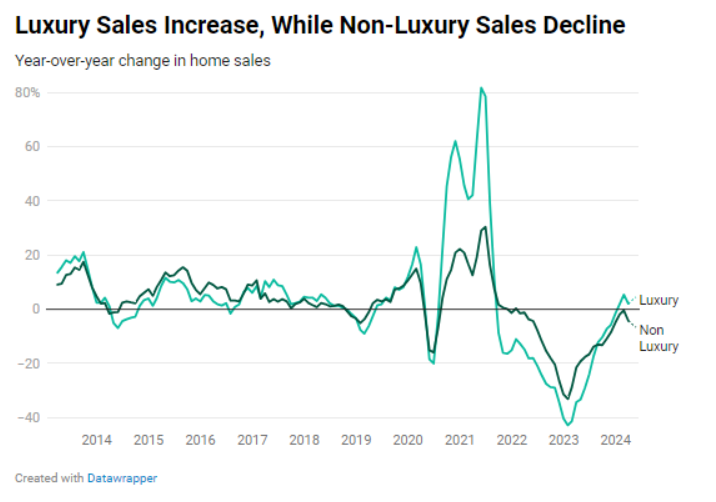

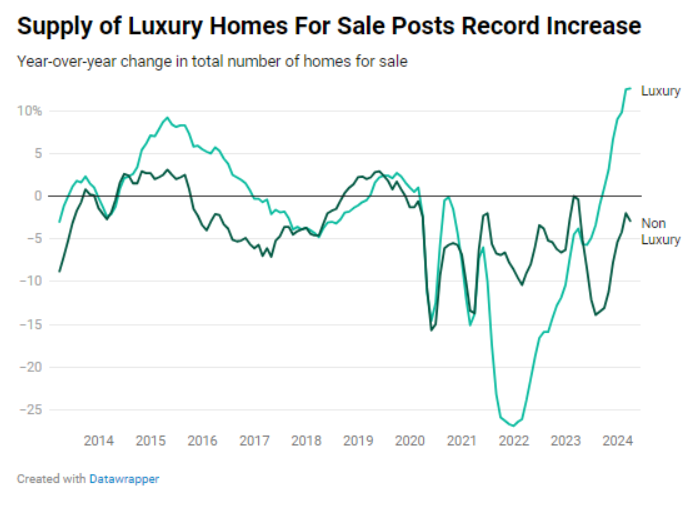

Luxury prices are rising largely because demand for high-end homes has held up better than demand for middle-of-the-road homes. Sales of luxury homes are on the upswing, partly because many high-end buyers are undeterred by high mortgage rates, with the share of luxury homes bought in cash sitting at record highs. New listings of luxury homes are soaring—but not enough to curb the price growth that comes with rising demand.

“People with the means to buy high-end homes are jumping in now because they feel confident prices will continue to rise,” said David Palmer, a Redfin Premier Agent in the Seattle metro area, where the average median-priced luxury home sells for $2.7 million. “They’re ready to buy with more optimism and less apprehension. It’s a similar sentiment on the selling side: Prices continue to increase for high-end homes, so homeowners feel it’s an ideal time to cash in on their equity. Even though mortgage rates remain elevated, and demand isn’t as high as it was during the pandemic, many homebuyers and sellers feel the worst of the housing downturn is behind us.”

Cash is king

While sales of luxury homes rose 2.1% year-over-year in Q1, luxury sales started posting year-over-year increases in January for the first time since August 2021. On the other end of the spectrum, sales of non-luxury homes decreased 4.2% year over year. Non-luxury sales haven’t posted an increase since the end of 2021.

Sales are growing for luxury homes and declining for non-luxury homes largely because so many affluent buyers are able to pay in cash. These particular buyers are not impacted by the state of today’s rate environment, as Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) eclipsed the 7%-mark, averaging 7.10% as of April 18, 2024. Nearly half (46.8%) of the luxury homes bought during the three months ending February 29 were purchased in cash—the highest share in at least a decade and up from 44.1% a year earlier.

Luxury home supply on the rise

The total number of luxury homes for sale rose 12.6% from a year earlier in Q1, the biggest increase on record. That’s compared with a 2.9% decline in non-luxury inventory. New listings of luxury homes soared 18.5% year-over-year in Q1, the second consecutive quarter of double-digit increases, and roughly seven times larger than the 2.7% increase for non-luxury homes.

Redfin found that the supply of luxury homes is rising for a number of reasons:

- Mortgage-rate lock-in effect has a lesser impact on luxury homeowners because they’re more apt to buy their next home in cash or be in a financial position to take on a higher rate.

- Owners of luxury homes, many of whom have a lot of equity, are putting their houses on the market to cash in while prices are at record highs.

- Luxury supply had a lot of room to grow, as it was sitting at low levels during Q1 of 2023.

Q1 metro-level luxury home highlights

Redfin’s metro-level luxury data includes the 50 most populous U.S. metros. Some metros are removed from time to time, to ensure data accuracy. All changes noted below are year-over-year changes:

- Home prices: The median sale price of luxury homes rose the most in Providence, Rhode Island (16.2% increase to $1,400,000); New Brunswick, New Jersey (15% increase to $1,900,000); and Virginia Beach, Virginia (12.8% increase to $1,100,000). It fell in just eight metros, with the biggest declines in New York (-9.9% to $3,250,000); Austin, Texas (-6.9% to $1,629,300); and Minneapolis (-2% to $975,000).

- Luxury home sales: Luxury home sales rose in just over half the metros, increasing the most in Seattle (36.9%); Austin, Texas (25.5%); and San Francisco (23.9%). They decreased the most in Newark, New Jersey (-23.6%); Philadelphia (-23%); and Detroit (-19.4%).

- Active luxury home listings: The total number of luxury homes for sale increased most in Austin, Texas (40.5%); Jacksonville, Florida (35.9%); and Fort Worth, Texas (32%). Total inventory fell in 15 metros, with the biggest drops reported in Detroit (-16.8%); Atlanta (-14.1%); and Chicago (-13%).

- New luxury home listings: New listings of luxury homes increased most in Jacksonville, Florida (63.6%); Fort Worth, Texas (41.7%); and Nassau County, New York (40.5%). New listings fell in eight metros, with the biggest declines reported in Detroit (-17%); Atlanta (-8.2%); and Chicago (-7.7%).

- Speed of luxury home sales: Luxury homes sold fastest in Seattle; Oakland, California; and San Jose, with median days on market of nine, 12 and 12, respectively. They sold the slowest in Miami (118 days); Austin, Texas (106); and Nashville (104).

Click here for more on Redfin’s report on Q1 luxury home sales.