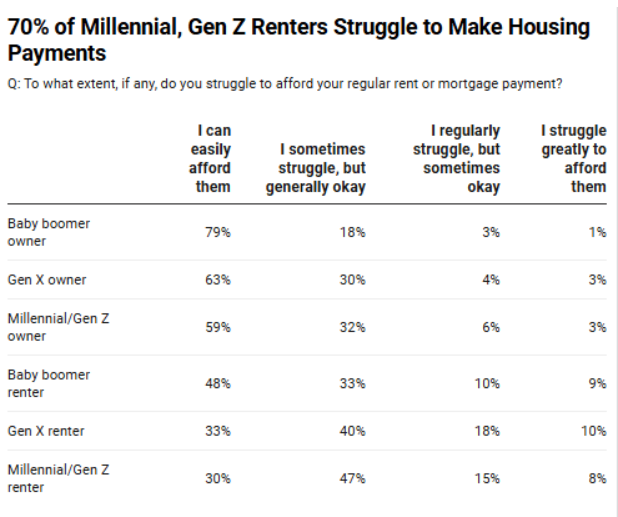

Redfin reports that seven in 10 Gen Z and millennial renters are struggling to afford their regular housing payments, as do 41% of homeowners in that age group. The report is based on a survey commissioned by Redfin and conducted by Ipsos in May 2025, examining more than 4,000 U.S. homeowners and renters. The report focuses on the nearly 2,000 respondents who said they struggle to afford housing, broken down by generation and whether they own or rent. Survey respondents were considered to struggle with housing payments if they selected, “I struggle greatly to afford them,” “I regularly struggle, but sometimes okay,” or “I sometimes struggle, but generally okay.”

The study found that baby boomers and Gen Xers are less likely to struggle, but 52% of baby boomer renters, and more than two-thirds of Gen X renters report having a hard time making their regular housing payments.

Of the Gen Z and millennial renters who struggle to afford housing, 40% are eating out at restaurants less often to make their monthly rent payments, making it the most common sacrifice among that group. The next-most common sacrifice is taking no or fewer vacations; nearly one-third of Gen Z and millennial renters selected that option.

“Many Gen Zers and millennials are making real sacrifices—picking up side gigs, selling their possessions, even delaying doctor’s appointments—just to pay for the basic need of housing,” said Daryl Fairweather, Redfin’s Chief Economist. “At the same time, a lot of the young people who can easily afford housing can do so because they have major financial support from their parents, with roughly one-quarter of the young Americans who recently bought a home using family money for their downpayments. With the cost of buying a home rising much faster than wages, people without access to family money are much more likely to struggle to pay for housing—which could widen the gap between the haves and the have-nots in the future.”

Twenty-two percent of young renters reported skipping meals completely to make their monthly payments, while 22% have sold their belongings, and 19% have delayed medical treatments.

Struggling millennials and Gen Zers who own their homes are more likely than those who rent to sacrifice luxuries, namely eating out at restaurants (43%) and taking vacations (36%). But they’re less likely to sacrifice necessities: Just about one in 10 (11%) report skipping meals completely to make mortgage payments, and 13% have delayed medical treatments.

Older Americans are also most likely to sacrifice luxuries such as eating out at restaurants and taking vacations to afford housing. Nearly half (45%) of both baby boomer and Gen X homeowners say they ate out at restaurants less often to afford their mortgage, and roughly two in five of both groups took no or fewer vacations.

It’s difficult for many Americans to afford their housing payments because even though wages have increased, the cost of buying a home has increased more. The median U.S. home-sale price has increased more than 40% since just before the pandemic and mortgage rates have roughly doubled; meanwhile, wages have increased by about 28% over that period. The median U.S. asking rent rose by roughly 22% over that period. Redfin found it particularly difficult for young Americans to afford housing because they typically earn less money than older generations because they’re at the start of their career, and are more likely to have student loan debt, and less likely to have equity from a previous home.

Asking Rents Holding Many Back

As renters and homeowners struggle with affordability, a separate Redfin report found the median U.S. asking rent rose 1.7% ($30) year-over-year to $1,790 in July—the largest increase recorded since January 2023. July marked the second-consecutive year-over-year increase (the median asking rent rose 0.4% in June) following over two years of declining or flat rents. The median asking rent climbed 0.8% on a month-over-month basis in July over the reported June 2025 totals.

“Asking rents may be climbing because shrinking apartment supply is coinciding with growing renter demand, which is being fueled by the high cost of homeownership,” said Redfin Senior Economist Sheharyar Bokhari. “Rents have been sluggish for the past two years because the pandemic building boom created a surplus of supply, which left landlords scrambling to fill vacancies and gave renters negotiating power. But now a slowdown in apartment construction may be shifting the balance of power toward landlords.”

Where Is Affordability Improving?

There are some bright spots emerging on the affordability front, as mortgage rates have dropped to a 10-month low, buyers have more purchasing power, and fewer homes are selling above the asking price. Redfin agents report many sellers are willing to negotiate as they take note of today’s buyer’s market, in which there are hundreds of thousands more home sellers than buyers.

News late last week of Federal Reserve Chair Jerome Powell hinting at a slash in the fed funds rate at an economic symposium sponsored by the Federal Reserve Bank of Kansas City when he suggested that an unsteady labor market could benefit from lower rates could improve affordability for more.

Affordability has started to improve in several major metro areas, too, as the income required to afford a median-priced local home has declined from a year ago in 11 of the biggest metros in the nation, including parts of California and Florida.

“A lot of renters are making the jump into homeownership,” said Jim Fletcher, a Redfin Premier Agent in Tampa, Florida. “The local market is slow, with builders offering incentives to entice people to buy and individual sellers willing to negotiate because there’s so much supply on the market. It’s a good time for people early in their careers to start building equity; they can get homes for less than they could have a few years ago—especially if they’re open to condos or townhouses.”

Delaying Major Purchases

A separate study by Redfin found that due concerns about job security, 44% of American workers are postponing or canceling a significant purchase, such as a home or vehicle. Another 30% have either actually made a significant purchase earlier than anticipated or want to do so. Because of job security, an estimated 44% of American workers are postponing or canceling a significant purchase. Redfin found that nearly three out of five (57%) employees from households with incomes under $50,000 are either postponing or canceling significant purchase plans. This is in contrast to 35% of workers from households making $100,000 or more and 48% of workers from homes making $50,000 to $100,000. Nearly twice as many working renters (49%) as working homeowners (27%) are postponing a significant purchase.