In September, the national median payment that purchase applicants sought for dropped from $2,057 in August to $2,041, indicating an improvement in homebuyer affordability. This is in line with the Mortgage Bankers Association‘s (MBA) Purchase Applications Payment Index (PAPI), which uses information from the MBA Weekly Applications Survey (WAS) to calculate how new monthly mortgage payments change over time in relation to income.

“Homebuyer affordability conditions improved for the fifth consecutive month, as mortgage rates near the low 6 percent range improved purchasing power for prospective buyers,” Edward Seiler, MBA’s Associate VP of Housing Economics and Executive Director for Research Institute for Housing America. “Overall affordability is now at its highest level since August 2022, but the recent jump in rates will likely cause conditions to plateau. MBA is forecasting for rates to be around 6.3 by the end of the year.”

Key Findings of MBA’s September 2024 Purchase Applications Payment Index (PAPI):

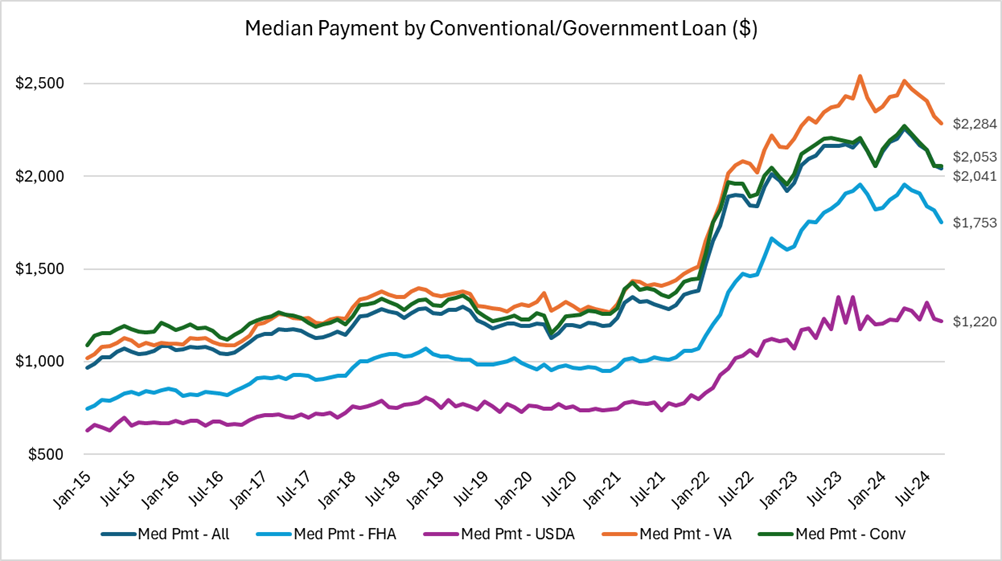

- The national median mortgage payment was $2,041 in September – down $16 from August. It is down by $114 from one year ago, equal to a 5.3% decrease.

- The national median mortgage payment for FHA loan applicants was $1,753 in September, down from $1,817 in August and down from $1,920 in September 2023.

- The national median mortgage payment for conventional loan applicants was $2,053, down from $2,056 in August and down from $2,180 in September 2023.

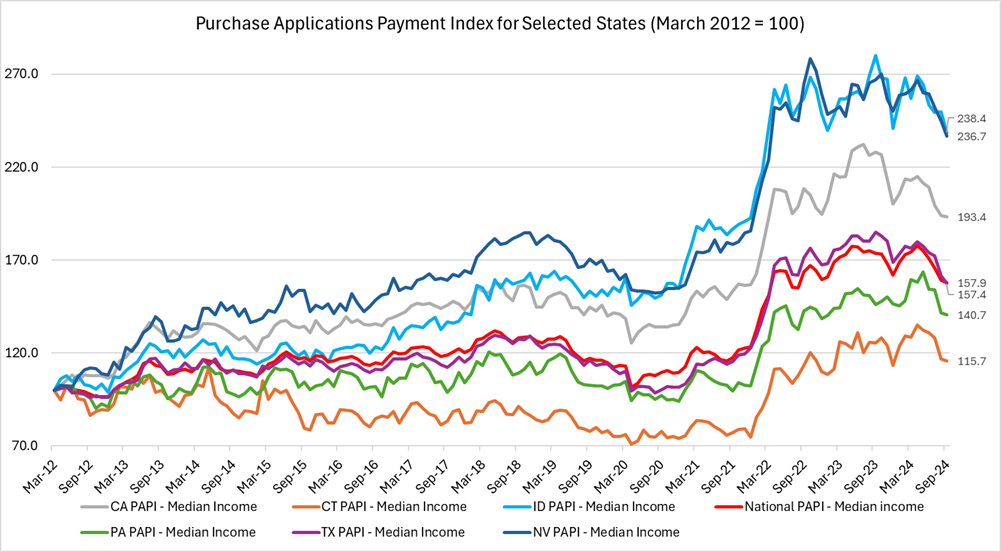

- The top five states with the highest PAPI were: Idaho (238.4), Nevada (236.7), Arizona (210.3), Florida (202.5), and Rhode Island (197.5).

- The top five states with the lowest PAPI were: Louisiana (109.6), Connecticut (115.7), New York (119.0), West Virginia (121.0), and Alaska (124.8).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 159.2 in August to 157.9 in September.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 151.2 in August to 150.1 in September.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 161.5 in August to 160.2 in September.

PAPI: New Home Affordability Improves

September saw an improvement in the affordability of new homes, according to the national PAPI index. Interest rates fell 31 basis points from August. With rates down 100 basis points from April, this is the seventh consecutive drop in rates. From $320,100, the median amount of a buy application rose to $328,000. When combined, our PAPI decreased. Since August 2022, it is at its lowest point. Every state except 10 experienced a decline in PAPI.

The mortgage payment to income ratio (PIR) is larger when the MBA’s PAPI rises, which is a sign of deteriorating borrower affordability conditions. This can be caused by rising mortgage rates, growing application loan amounts, or a decline in earnings. When loan application amounts, mortgage rates, or incomes decline, the PAPI declines, which is a sign of improving borrower affordability conditions.

In September, the national PAPI dropped from 159.2 in August by 0.8% to 157.9. The PAPI is down 9.1% annually due to the low wage increase, with median earnings up 4.2% from a year earlier and payments down 5.3%. The September national mortgage payment dropped from $1,388 in August to $1,369 for borrowers seeking for lower-payment mortgages (the 25th percentile).

The median mortgage payment for purchase mortgages from MBA’s Builder Application Survey dropped from $2,362 in August to $2,333 in September, according to the Builders’ Purchase Application Payment Index (BPAPI).

To read the full report, including more data, charts, and methodology, click here.